bni APP

Redefining insurance services to a new generation segment

. Next-Gen Insurance

. Innovative

. User-Friendly

Embarking on a Transformative Journey: Redefining Insurance for Millennials and Generation Z with Digital Presence

This project takes substantial steps to redefine insurance for Millennials and Generation Z with a digital transformation adoption. In this case study, you are invited to delve into our detailed UX/UI journey, gaining insights into how we are strategically positioning BNI as the definitive insurance partner for the future through the introduction of cutting-edge digital solutions. Our unwavering focus remains on delivering an experience that not only prioritizes efficiency but is also inherently user-friendly and reliably responsive. Aligned with BNI’s core aspirations, we are meticulously crafting a set of unprecedented standards in the continually evolving landscape of insurance services, ensuring a seamless and evolved future for potential Millennials and Generation Z policyholders.

BNI, a renowned traditional insurance company, seeks to engage and retain the tech-savvy younger generations, namely Millennials and Gen Z, by aligning with their digital expectations for transparent, personalized, financial services. Recognizing the evolving preferences of these demographics, BNI aims to bridge the gap between its traditional offerings and the modern needs of new customers by providing flexible, efficient and intuitive insurance eServices.

This case study aims to:

- Provide a comprehensive understanding of challenges, methodologies, and solutions in enhancing the user experience for BNI’s digital services.

- Offer insights into the user-centric design process, including research findings and outcomes.

- Explore the impact of the suggested solutions & design throughout the usability testing method on the user experience transformation.

Throughout the Designing Process for BNI, I was able to contribute the following roles:

- UX Researcher

- UX / UI Designer

- Usability Tester

| 20th DEC 2023 | 22nd DEC 2023 | 24th DEC 2023 | 26th DEC 2023 | ✦ | ||||

| ✦ | 21st DEC 2023 | 23rd DEC 2023 | 25th DEC 2023 | 27th DEC 2023 |

Figma Figma |  Photoshop Photoshop |  Procreate Procreate | |

cam & recorder cam & recorder |

As we dive into our case study, here’s an overview of the key content in our case study :

Company Overview: About BNI, who they are, what they do, and their digital services.

Target Audience (Millennials & Gen Z): Learn about the audience we’re focusing on.

Research Phase: We’ll analyse, synthesise, and share key findings.

Design Phase (Sketching & Prototyping & Testing): See how ideas come to life and get tested.

Advancing Ahead (Operational Requirements & Next Steps): What comes next?

Knowledge acquired (Lessons Learned & Conclusion): Summing up our experience.

This project is an output of the User Experience Design Immersive course facilitated by General Assembly. It’s important to note that the content and materials herein do not constitute an official expression of BNI’s views or endorsement. The incorporation of BNI’s logo and copyrighted materials has been specifically authorized by General Assembly exclusively for educational purposes. All intellectual property rights, including original content and logos, remain the exclusive property of their respective copyright holders. It is imperative to emphasize that this project serves a strictly educational and illustrative purpose and should not be misconstrued as an official statement or representation of BNI or its affiliates.

Embarking on a Transformative Journey: Redefining Insurance for Millennials and Generation Z with Digital Presence

This project takes substantial steps to redefine insurance for Millennials and Generation Z with a digital transformation adoption. In this case study, you are invited to delve into our detailed UX/UI journey, gaining insights into how we are strategically positioning BNI as the definitive insurance partner for the future through the introduction of cutting-edge digital solutions. Our unwavering focus remains on delivering an experience that not only prioritizes efficiency but is also inherently user-friendly and reliably responsive. Aligned with BNI’s core aspirations, we are meticulously crafting a set of unprecedented standards in the continually evolving landscape of insurance services, ensuring a seamless and evolved future for potential Millennials and Generation Z policyholders.

BNI, a renowned traditional insurance company, seeks to engage and retain the tech-savvy younger generations, namely Millennials and Gen Z, by aligning with their digital expectations for transparent, personalized, financial services. Recognizing the evolving preferences of these demographics, BNI aims to bridge the gap between its traditional offerings and the modern needs of new customers by providing flexible, efficient and intuitive insurance eServices.

This case study aims to:

- Provide a comprehensive understanding of challenges, methodologies, and solutions in enhancing the user experience for BNI’s digital services.

- Offer insights into the user-centric design process, including research findings and outcomes.

- Explore the impact of the suggested solutions & design throughout the usability testing method on the user experience transformation.

Throughout the Designing Process for BNI, I was able to contribute the following roles:

- UX Researcher

- UX / UI Designer

- Usability Tester

| 20th DEC 2023 | ✦Start | ✦End | 27th DEC 2023 |

Figma Figma |

Photoshop Photoshop |

|

Procreate Procreate |

As we dive into our case study, here’s an overview of the key content in our case study :

Company Overview: About BNI, who they are, what they do, and their digital services.

Target Audience (Millennials & Gen Z): Learn about the audience we’re focusing on.

Research Phase: We’ll analyse, synthesise, and share key findings.

Design Phase (Sketching & Prototyping & Testing): See how ideas come to life and get tested.

Advancing Ahead (Operational Requirements & Next Steps): What comes next?

Knowledge acquired (Lessons Learned & Conclusion): Summing up our experience.

This project is an output of the User Experience Design Immersive course facilitated by General Assembly. It’s important to note that the content and materials herein do not constitute an official expression of BNI’s views or endorsement. The incorporation of BNI’s logo and copyrighted materials has been specifically authorized by General Assembly exclusively for educational purposes. All intellectual property rights, including original content and logos, remain the exclusive property of their respective copyright holders. It is imperative to emphasize that this project serves a strictly educational and illustrative purpose and should not be misconstrued as an official statement or representation of BNI or its affiliates.

1 .COMPANY OVERVIEW

Get to know who they are, what they do, and their digital services.

bni Insurance

Bahrain’s leading insurance company with over 50 years of experience in motor, personal lines and commercial insurance.

Bahrain National Insurance Company (BNI) is a wholly-owned subsidiary of

Bahrain National Holding Company and the General Insurance arm of the Group,

offering a full range of products for businesses and individuals.

BNI has over 50 years of experience in handling individual and commercial insurance.

The company has an authorized capital of BD 10 million (US$ 26.5 million) and a

paid-up capital of BD 6.5 million (US$ 17.2 million). Striving to continuously

provide superior services along with innovative products and solutions to its clients.

With the active & rapid expansion in the economic activity in the Kingdom of Bahrain,

bni is proud to be actively present, providing its esteemed commercial & industrial

clients with innovative and tailor-made insurance products.

The products offered by BNI’s Commercial Insurance Department cover a variety of

risk exposures providing peace of mind and allowing entrepreneurs, businessmen

and financiers to focus on making their investment a success. Aiming to combine

superior service with innovative products, quality Motor and Personal Lines insurance

solutions are provided by BNI for private individuals and companies.

The company today is a leading motor insurer in the Kingdom with a steadily growing

base of clients who have also chosen to trust BNI with their other personal insurance

requirements such as Home, Travel and Domestic help insurance.

Bahrain National Insurance Company (BNI) is a wholly-owned subsidiary of Bahrain National Holding Company and the General Insurance arm of the Group, offering a full range of products for businesses and individuals.

BNI has over 50 years of experience in handling individual and commercial insurance.

The company has an authorized capital of BD 10 million (US$ 26.5 million) and a paid-up capital of BD 6.5 million (US$ 17.2 million). Striving to continuously provide superior services along with innovative products and solutions to its clients.

With the active & rapid expansion in the economic activity in the Kingdom of Bahrain, bni is proud to be actively present, providing its esteemed commercial & industrial clients with innovative and tailor-made insurance products.

The products offered by BNI’s Commercial Insurance Department cover a variety of risk exposures providing peace of mind and allowing entrepreneurs, businessmen and financiers to focus on making their investment a success. Aiming to combine superior service with innovative products, quality Motor and Personal Lines insurance solutions are provided by BNI for private individuals and companies.

The company today is a leading motor insurer in the Kingdom with a steadily growing base of clients who have also chosen to trust BNI with their other personal insurance requirements such as Home, Travel and Domestic help insurance.

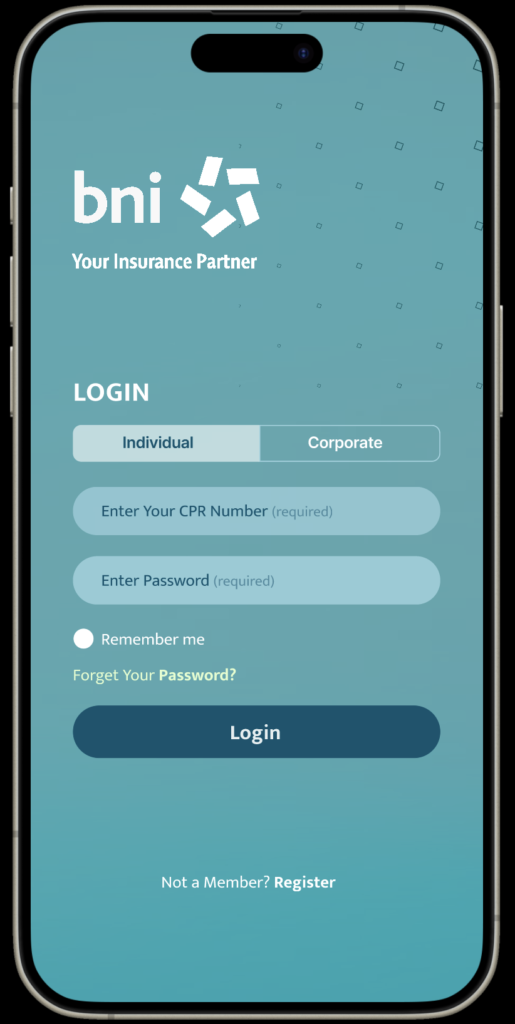

Referring to the fact that bni is a traditional insurance company with a strong

reputation, the overall provided services are based on face-to-face communication,

but with the growing presence of technology in plenty of industries, bni utilized

the use of social media platforms besides launching its official website to keep tracking

the digitalizing trend. This development in terms of insurance services guided the

company to provide virtual communication with dedicated agents via a third-party

mobile App, which provides potential clients with a real-time experience.

This resulted in broadening bni’s scope of audiences to include Millenials & Gen Z

who are increasingly tech-savvy and have different expectations for service

and convenience.

Referring to the fact that bni is a traditional insurance company with a strong reputation, the overall provided services are based on face-to-face communication, but with the growing presence of technology in plenty of industries, bni utilized the use of social media platforms besides launching its official website to keep tracking the digitalizing trend. This development in terms of insurance services guided the company to provide virtual communication with dedicated agents via a third-party mobile App, which provides potential clients with a real-time experience.

This resulted in broadening bni’s scope of audiences to include Millenials & Gen Z who are increasingly tech-savvy and have different expectations for service

and convenience.

2. Target audience

Learn about the audience we're focusing on.

Millinels & Gen Zs

Often acknowledged as tech-savvy younger demographics, Millennials and Gen Z now occupy the core of BNI's initiatives

to amplify engagement and expand their investor base.

This strategic focus underscores BNI's dedication to adjusting outreach strategies in harmony with the preferences and expectations of these digitally adept generations.

Consequently, our team has shifted attention towards the

emerging generation of users, meticulously identifying their demographics and key characteristics as outlined below:

Often acknowledged as tech-savvy younger demographics, Millennials and Gen Z now occupy the core of BNI's initiatives to amplify engagement and expand their investor base. This strategic focus underscores BNI's dedication to adjusting outreach strategies in harmony with the preferences and expectations of these digitally adept generations. Consequently, our team has shifted attention towards the emerging generation of users, meticulously identifying their demographics and key characteristics as outlined below:

-

Millennials

1981 - 1996

-

Generation Z

1996 - 2012

-

Gen Alpha

2013 - 2025

-

Millennials

1981 - 1996

-

Generation Z

1996 - 2012

-

Gen Alpha

2013 - 2025

Shared Traits

- Embrace Digital Platforms

- Authenticity & Transparency Matter

- Personalisation is Key

Gen Z and Millennials, being digitally fluent, extensively utilize digital platforms for information and interaction.

Both Generation Z and Millennials place a high premium on the importance of authenticity and transparency when engaging with brands. This demographic cohort highly values genuine connections and exhibits a preference for brands that align closely with their core values. This emphasis on authenticity and transparency underscores the pivotal role these factors play in shaping positive brand interactions with Gen Z and Millennials.

Gen Z and Millennials seek tailored experiences and messages. They are Targeting online services that align with their preferences and behaviors, customized product suggestions and interactive content can elevate engagement and boost conversions.

3. Research Phase

Learn about the audience we're focusing on.

User Research

After gaining a broad understanding of both the business (BNI) and the intended target audience, encompassing fundamental demographics and characteristics, the next phase involved an in-depth exploration of potential users using a robust UX research methodology. For user research, we opted for interviews as our chosen method.

User Interviews

We've chosen User Interviews as our preferred user research method due to its standalone application. This approach allows us to not only engage in face-to-face conversations with users but also observe their body language and expressions. The dynamic nature of interviews enables us to ask questions, receive responses, and seamlessly pose follow-up inquiries as needed.

5 Interviews

Millennials

& Gen Zs

10 Open-Ended

Questions

Explore a thorough analysis of the challenges encountered by potential Millennial and Gen Z users in their assessment of insurance services and areas of focus are follows:

- What’s the best experience that a Zillennial imagine dealing with an insurance company?

- What information is deemed necessary to know when buying insurance?

- The optimized way to go through the user journey.

- Before we begin, would you mind telling me a bit about yourself?

Do you live alone or with anyone else?

Tell me about your financial philosophy. Are you a saver, a spender, or somewhere in between? How does this approach influence your insurance decisions?

How comfortable are you using technology for financial tasks like managing insurance?

Walk me through a typical insurance process, from researching policies to filing a claim. Where do you encounter the biggest roadblocks or frustrations?

Let’s imagine you just signed up for the perfect insurance policy. Describe how the entire process unfolds, from initial contact to resolving a claim. What makes this experience seamless and stress-free?

Think back to a frustrating insurance experience you’ve had. What happened? How could this situation have been handled differently to turn it into a positive encounter?

f you had a magic button that instantly grants you a complete understanding of insurance, what aspects would you press it on? What knowledge gaps would you fill first?

If you could create your dream insurance policy, what unique features or benefits would it include?

Do you have anything else you’d like to share about this topic?

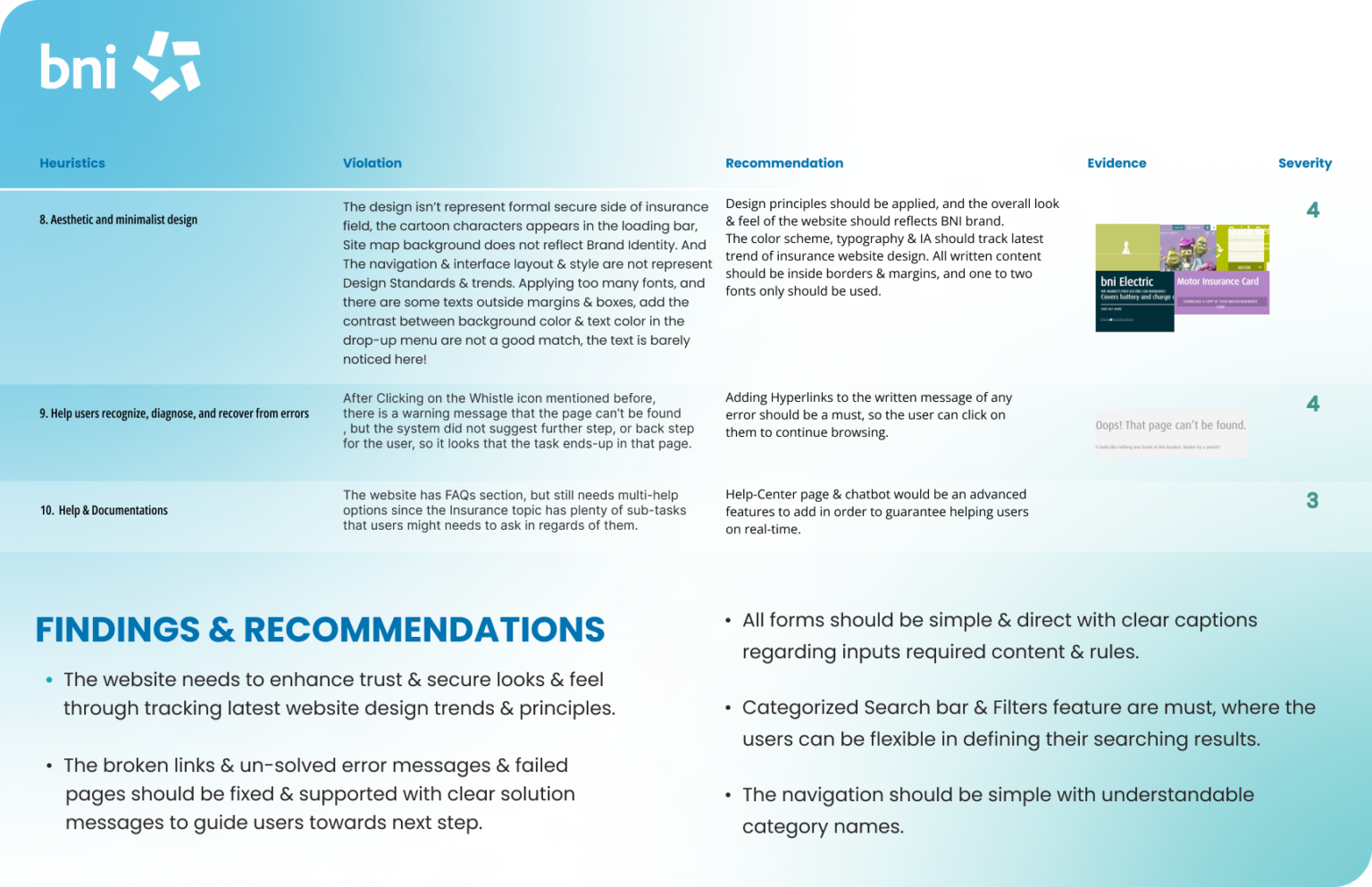

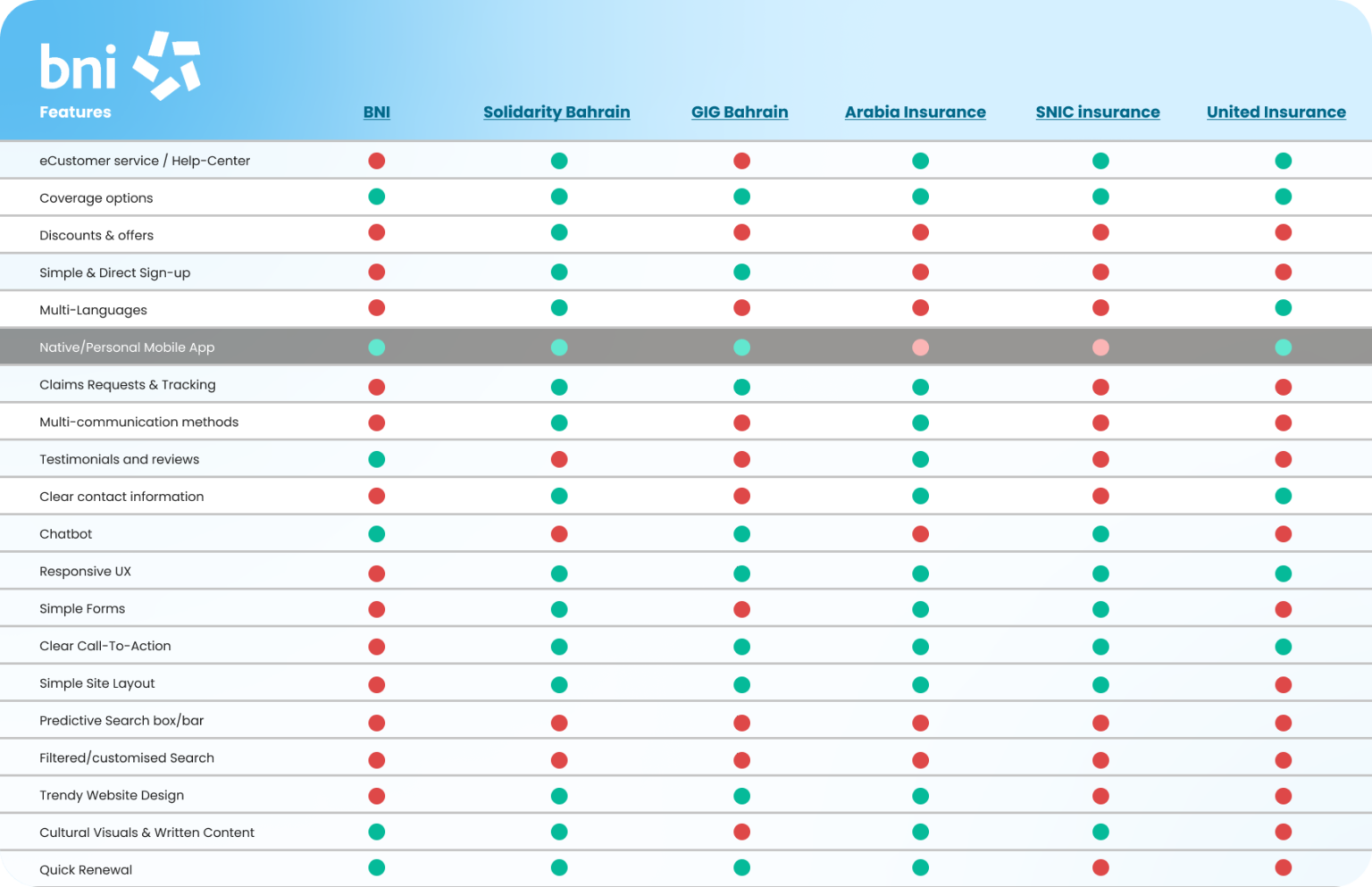

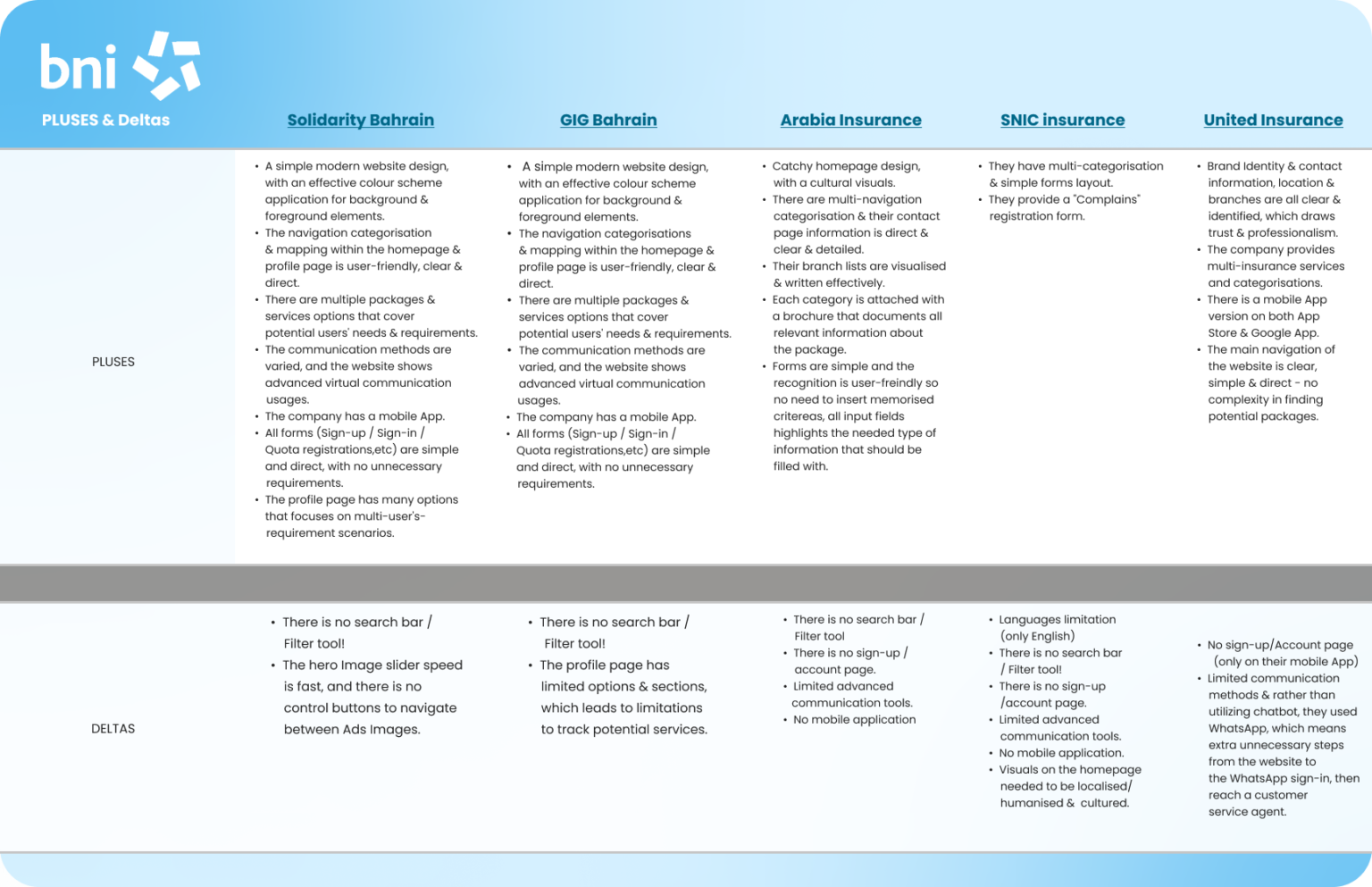

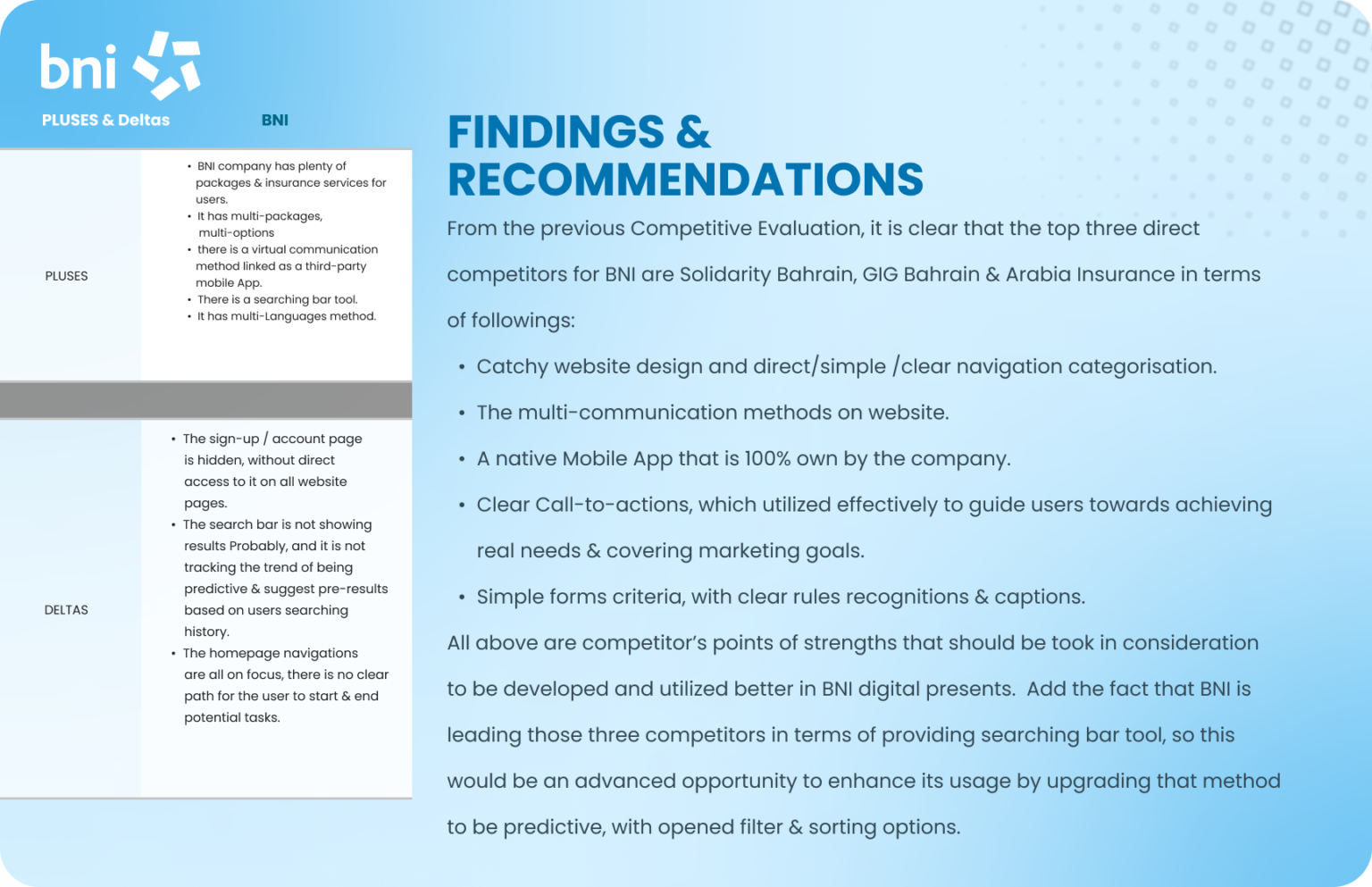

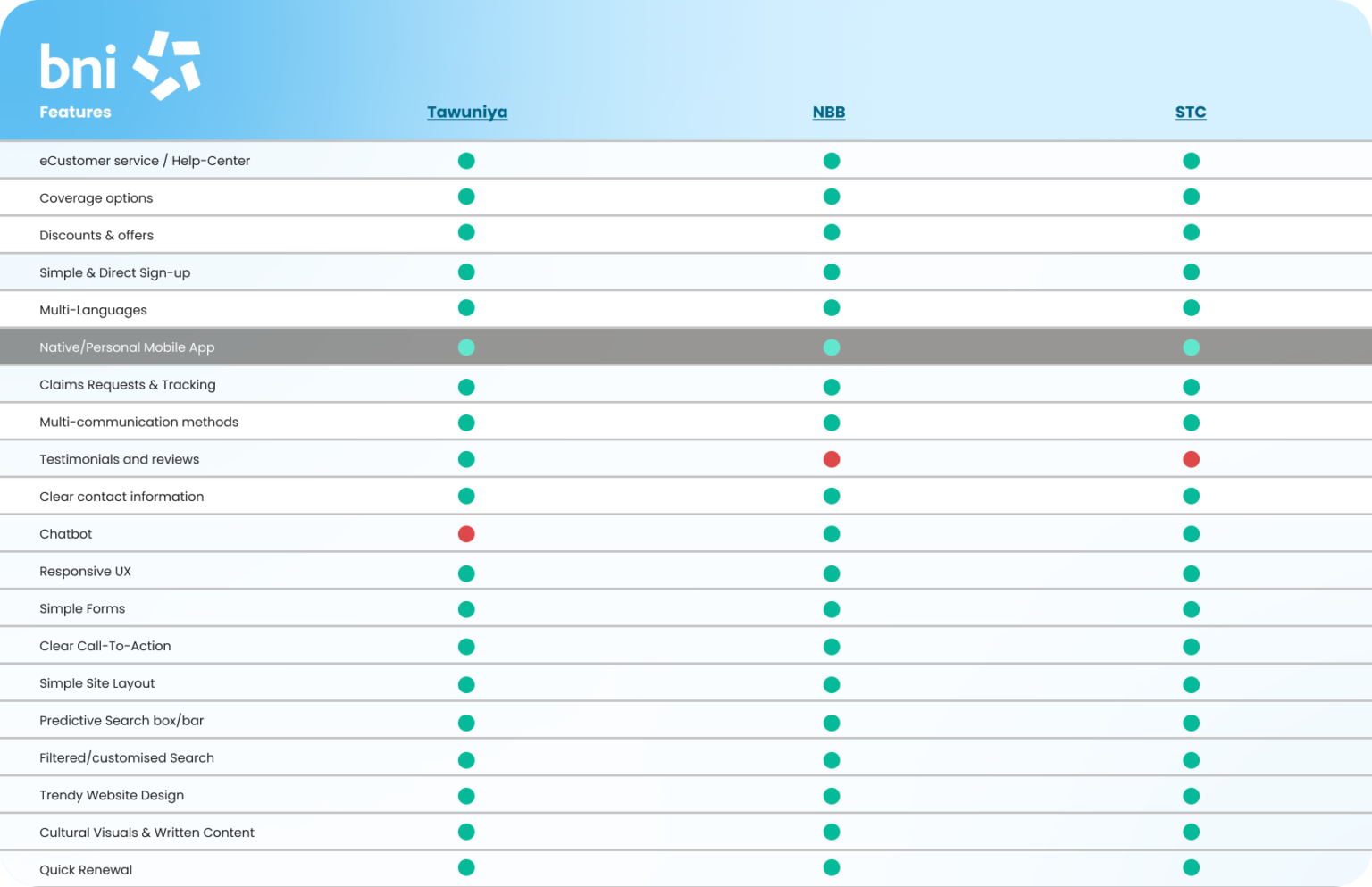

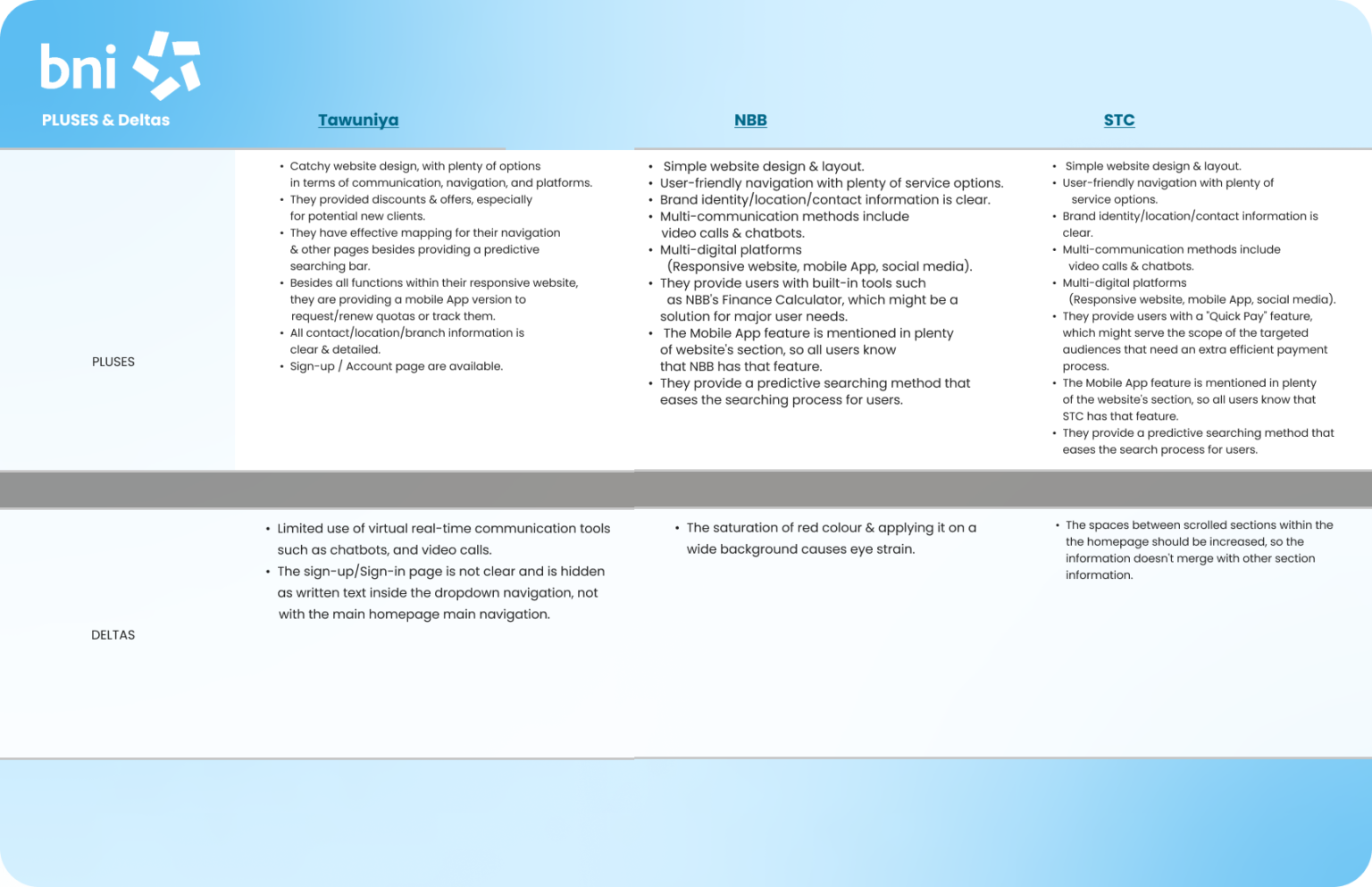

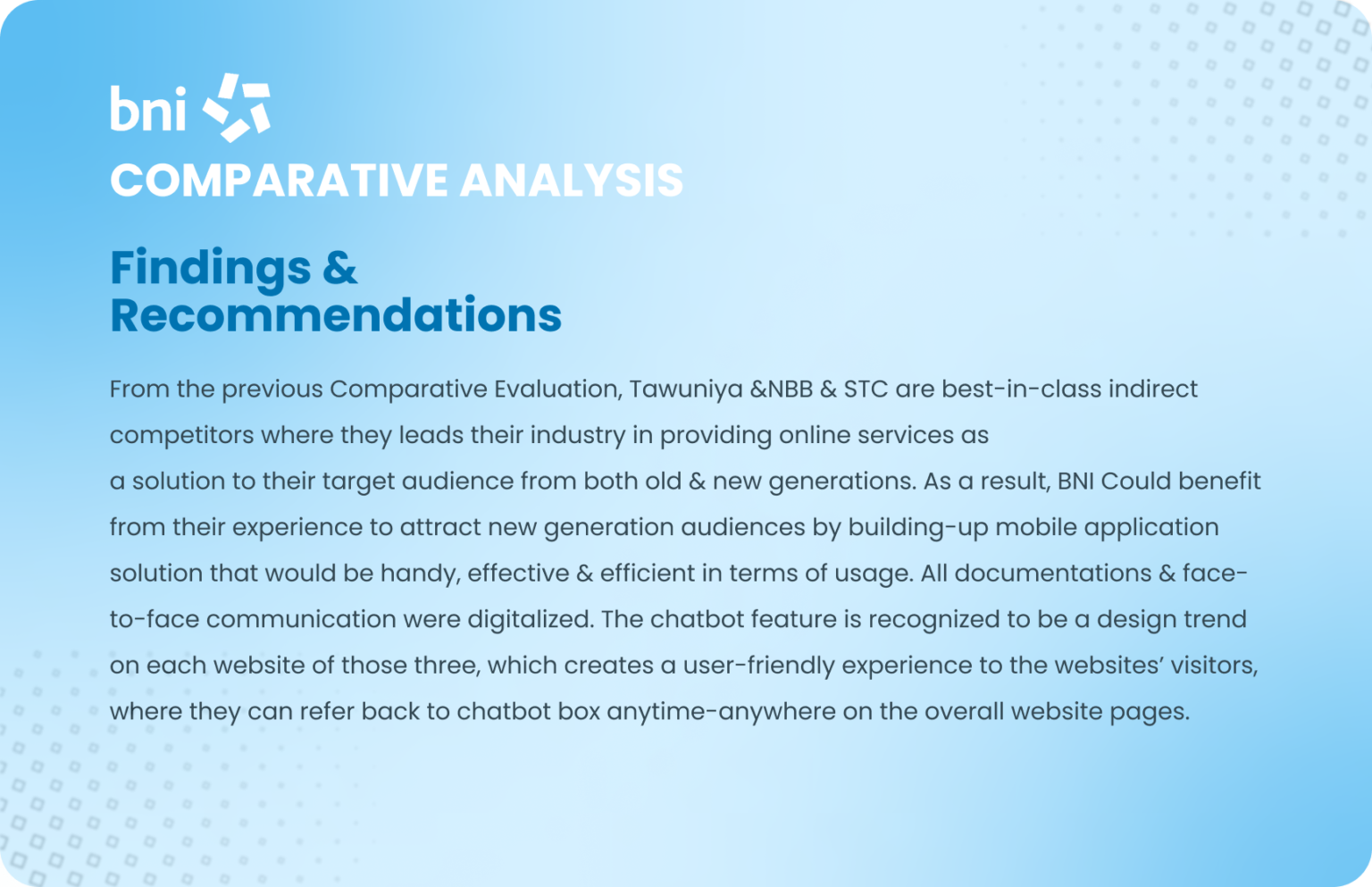

Business Research

This method of evaluation was chosen to examine BNI’s website, where the design was examined based on Nielsen’s 10 guidelines, which points to weaknesses & problems in the design that could be improved to guarantee the user-friendly usage of the website or to suggest a better digital solution to support website's services & features .

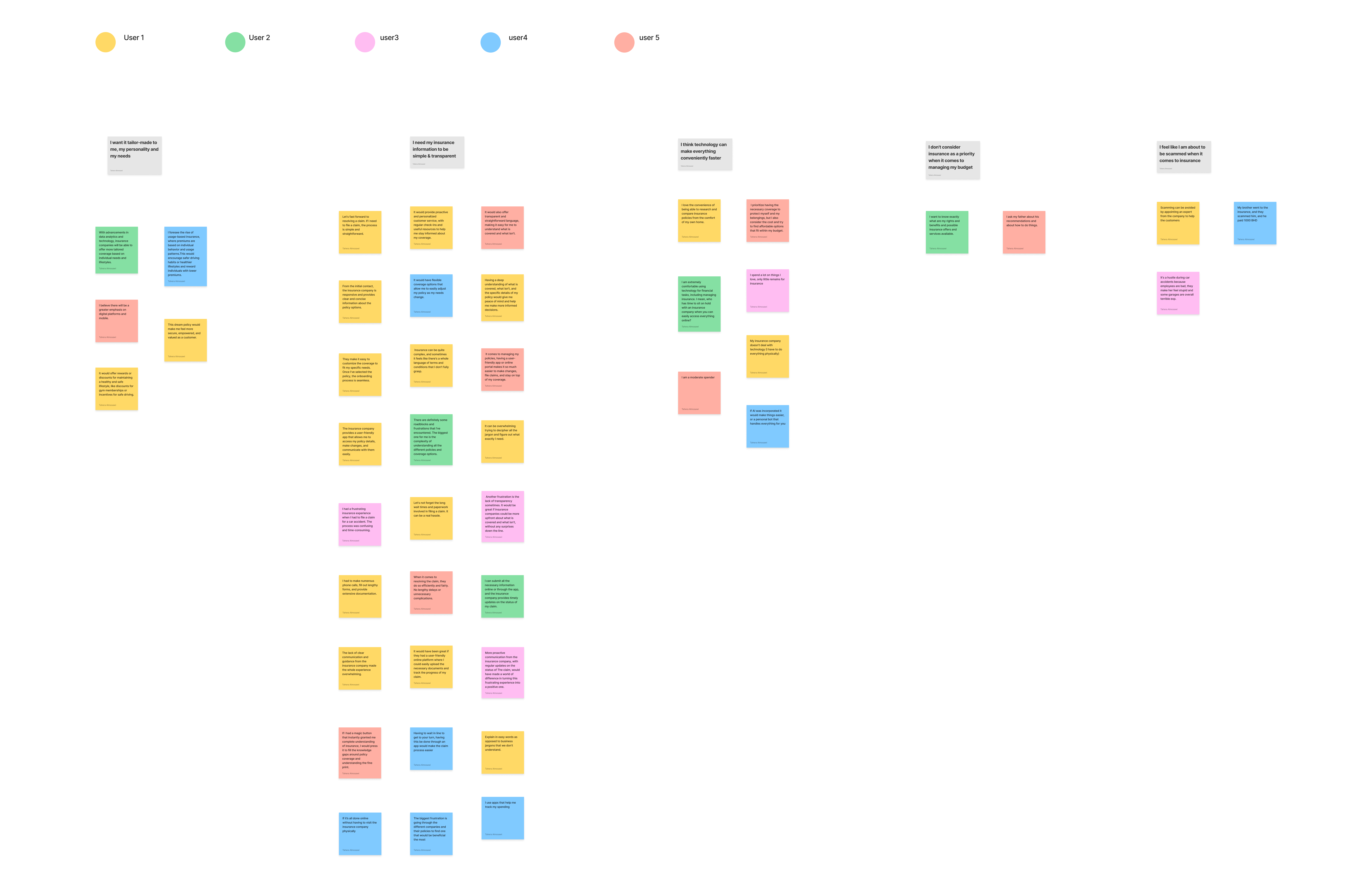

Affinity Mapping

Affinity mapping is like a helpful tool that shows patterns in how users behave, and what they like or do not like, what they need, their challenges and goals. Learning about affinity mapping helps set the stage for designing things better in the future. It's a handy method for teams and individuals to sort and understand lots of information easily, especially in design, project work, and problem-solving. So our team benefited from this powerful UX tool to gather all user quotes from interviews' data into sticky notes and then grap topic of trends as "I" statements as the following Affinity Maps illustrates:

By sorting each quote from all recorded Interviews, we pointed out a list of trends & “I” statements that represent users’ needs & challenges they encountered in terms of the insurance industry. As a result, we had a clear vision of what frustrations & problems we should focus on crafting solutions (features) to. The list of trends (i Statements) are:

- I want it tailor-made to me, my personality and my needs

- I need my insurance information to be simple & transparent

- I think technology can make everything convenient and faster

- I don’t consider insurance as a priority when it comes to managing my budget

- I feel like I am about to be scammed when it comes to insurance

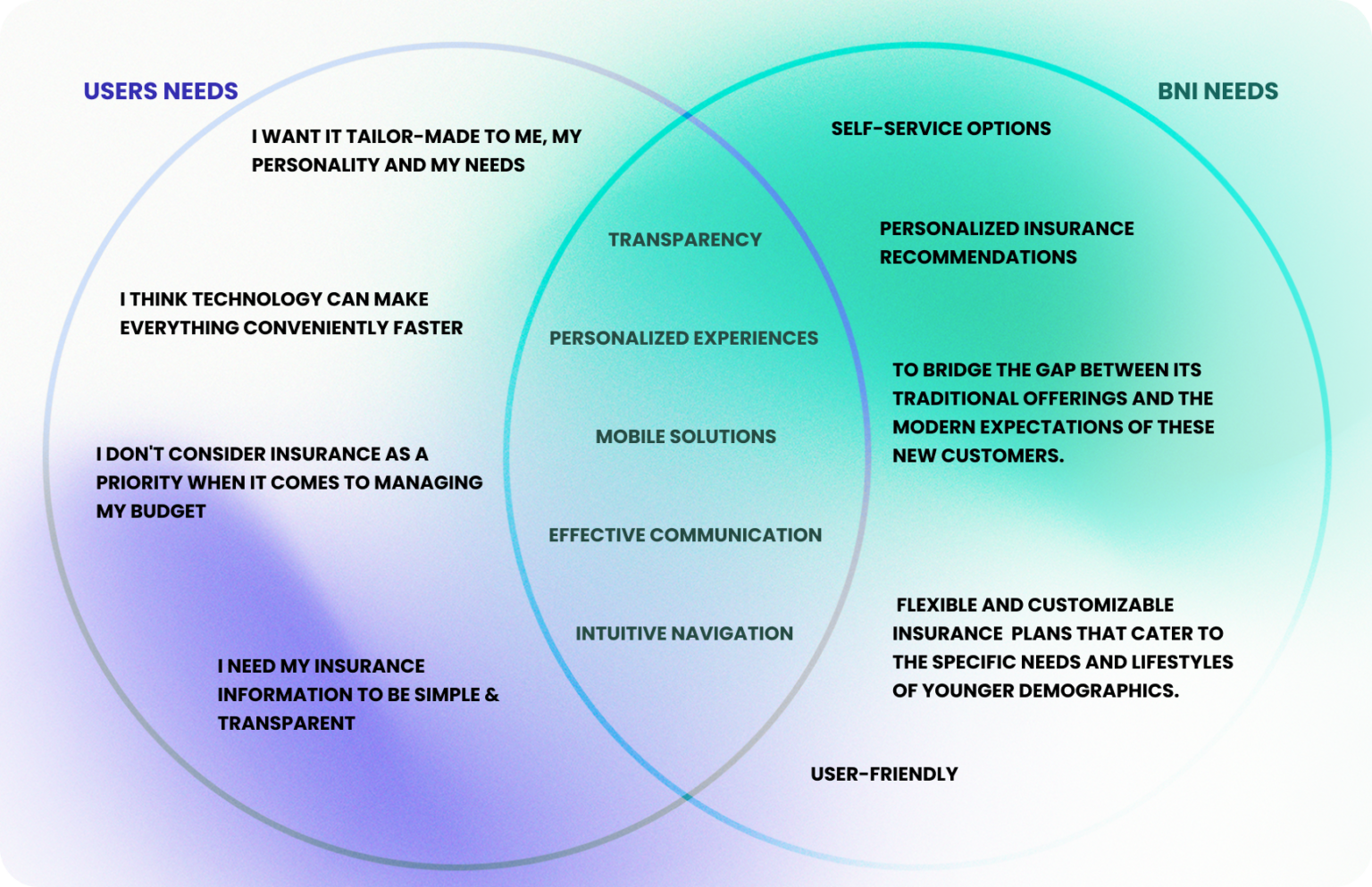

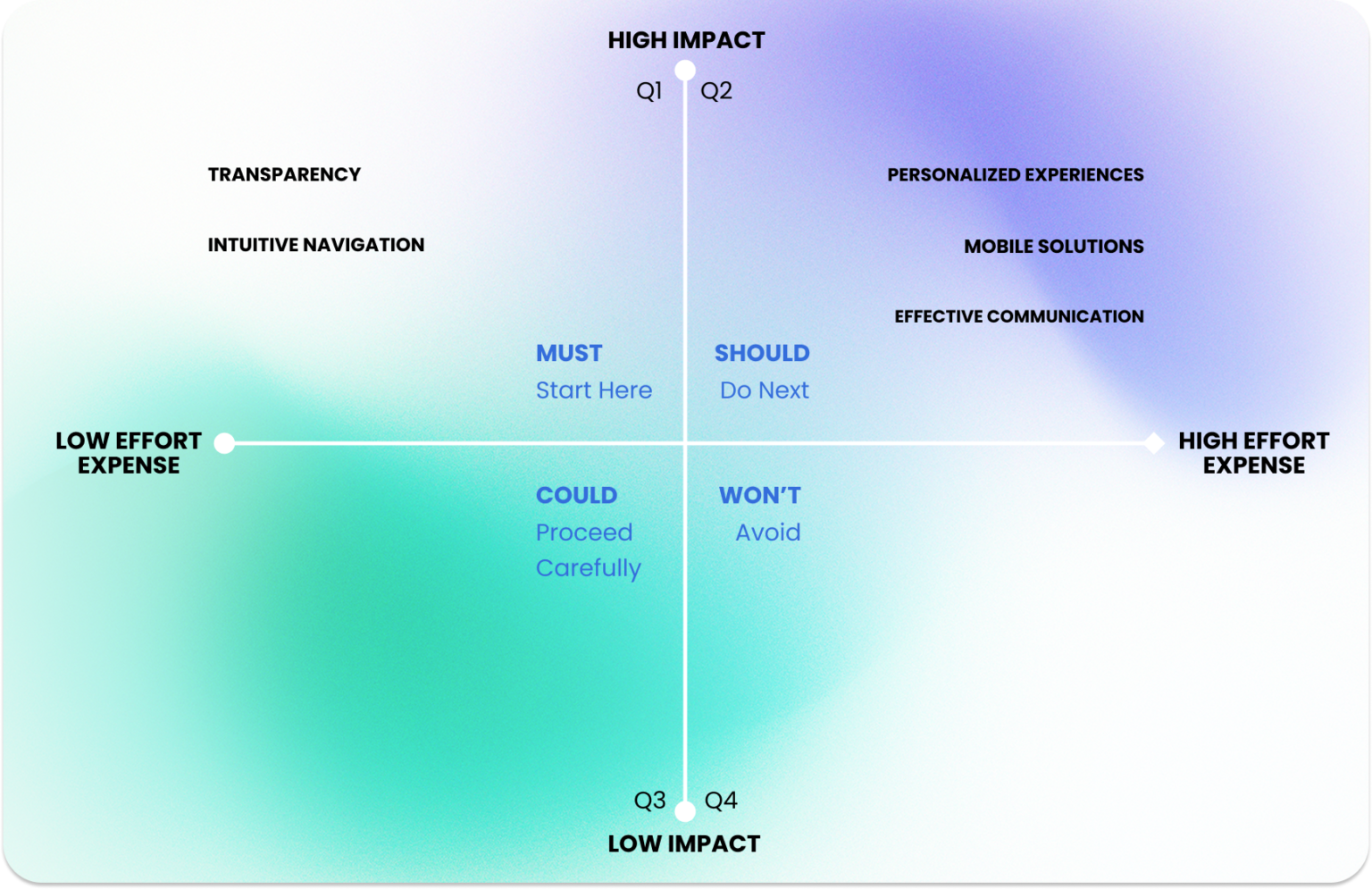

Feature Prioritization & MVPs

After collecting trends & "I" statements from affinity mapping, our team directed all attention towards finalizing the common points between Users' needs & BNI Business needs, so we focused on prioritising crafting solutions (features) that meet those specific similarities.

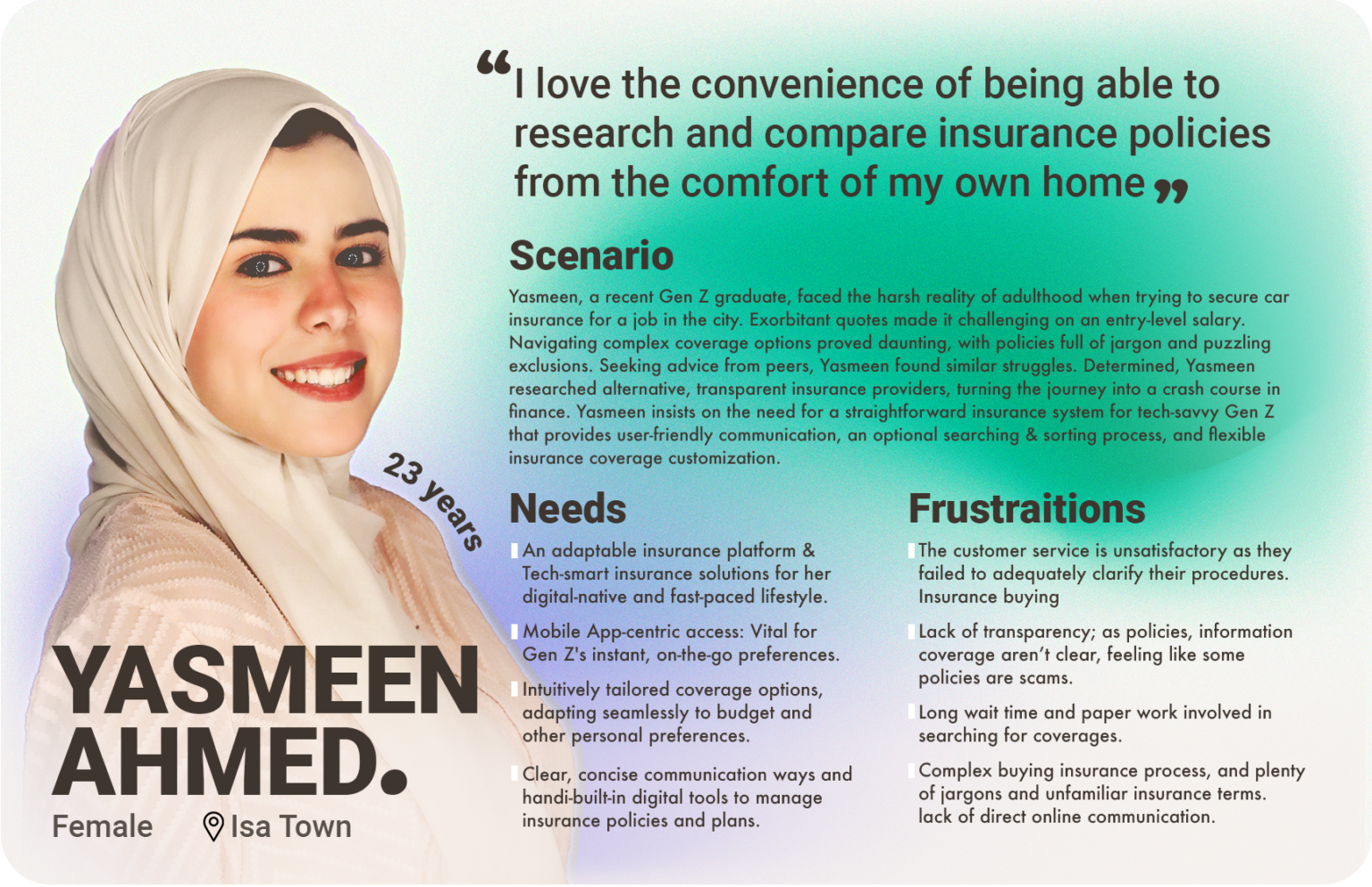

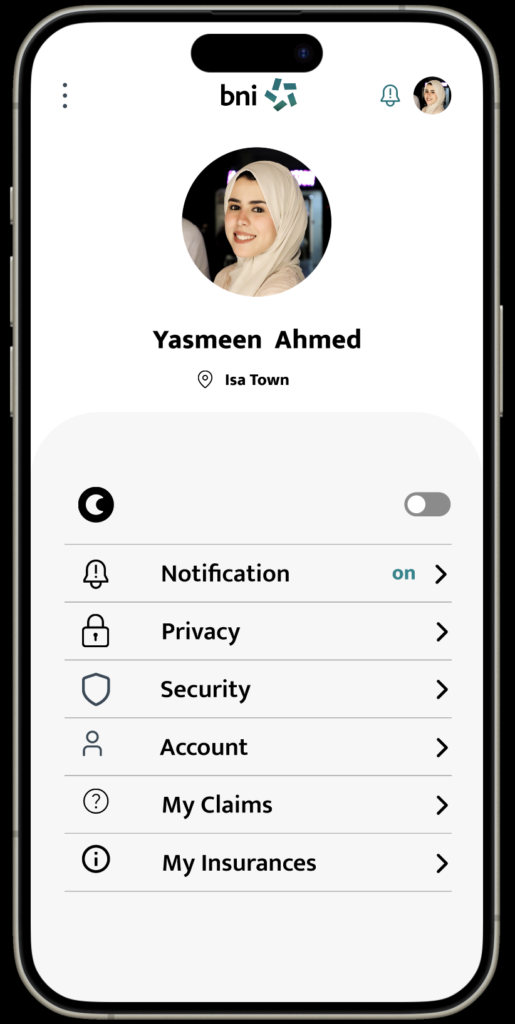

Personas

These personas depict actual users, each with distinct backgrounds, needs,

and aspirations, providing valuable insights into ways BNI can enhance services for a

scope range of insurance service seekers.

These personas depict actual users, each with distinct backgrounds, needs, and aspirations, providing valuable insights into ways BNI can enhance services for a scope range of insurance service seekers.

Yasmeen's

ProBlem statement

Yasmeen's

Problem Statement

Yasmeen needs a better way to have a trusted digital insurance App that provides user-friendly searching methods, flexible & customized insurance plans, with clear coverage terms and simple forms, so she can get a competitive insurance coverage plan and then sign a contract confidently and efficiently via here mobile anytime anywhere.

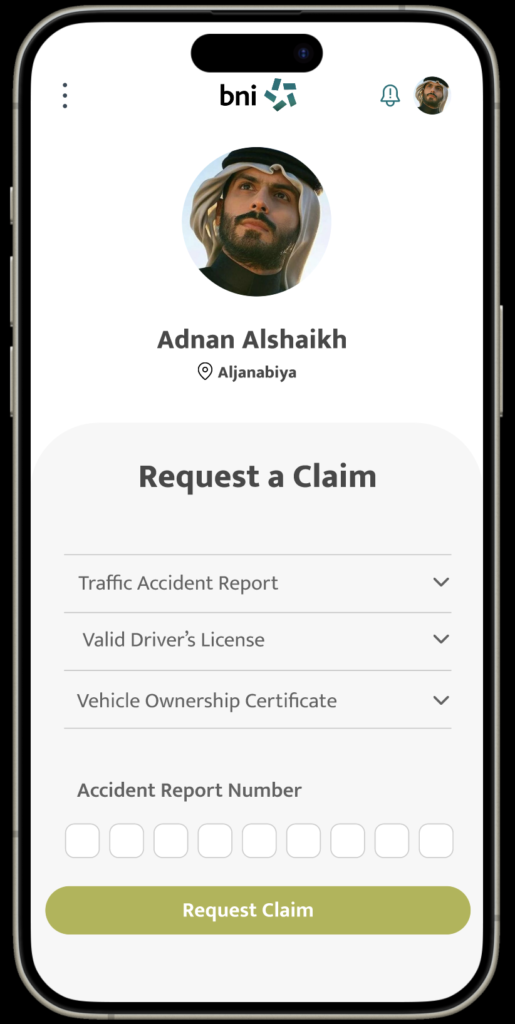

Adnan's

ProBlem statement

Adnan's

Problem Statement

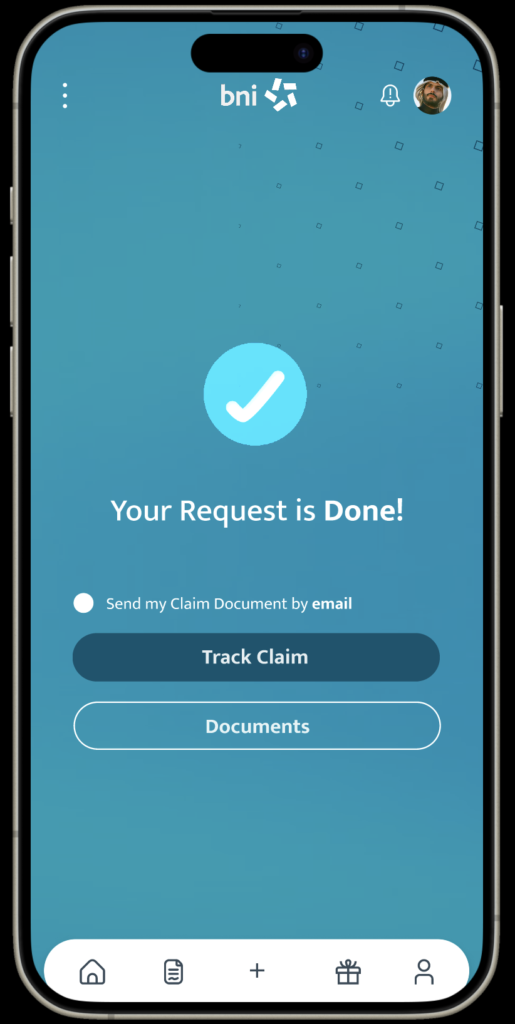

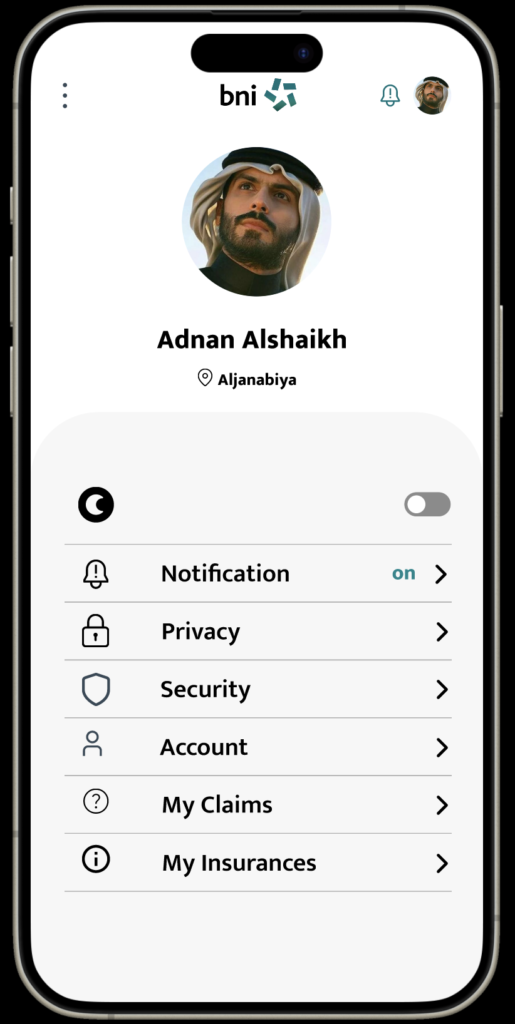

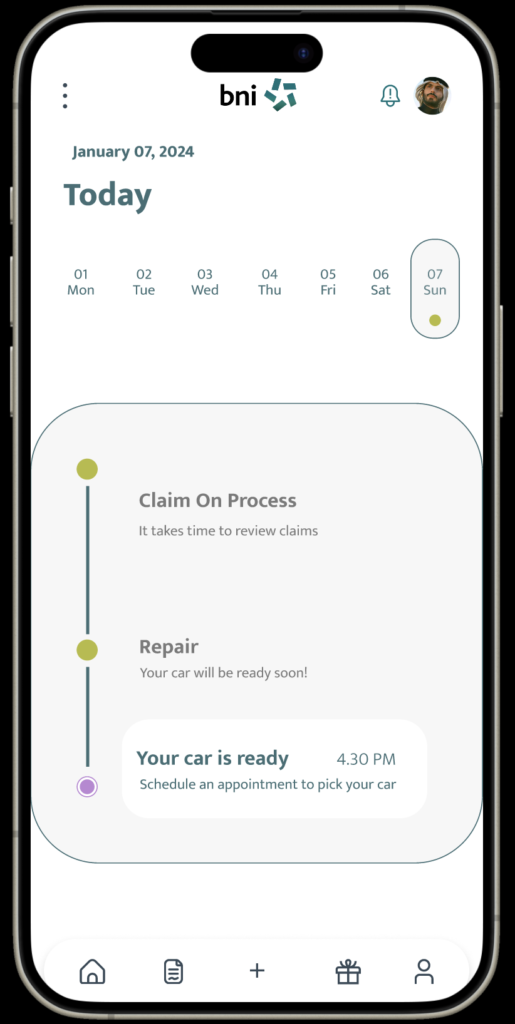

Adnan needs an effective & efficient digital insurance process to claim an accident or damage so he can submit, track and manage his reimbursement claims easily from his mobile device without waiting in lines.

Yasmeen's

ProBlem statement

Yasmeen needs a better way to have a trusted digital insurance App that provides user-friendly searching methods, flexible & customized insurance plans, with clear coverage terms and simple forms, so she can get a competitive insurance coverage plan and then sign a contract confidently and efficiently via here mobile anytime anywhere.

4. Crafting Solutions

Learn about the audience we're focusing on.

Solution statement

Solution Statement

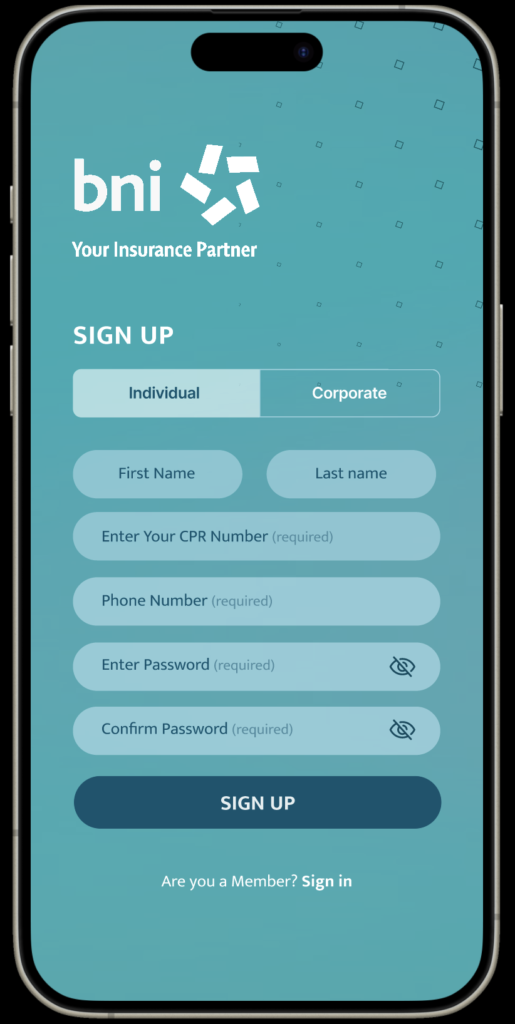

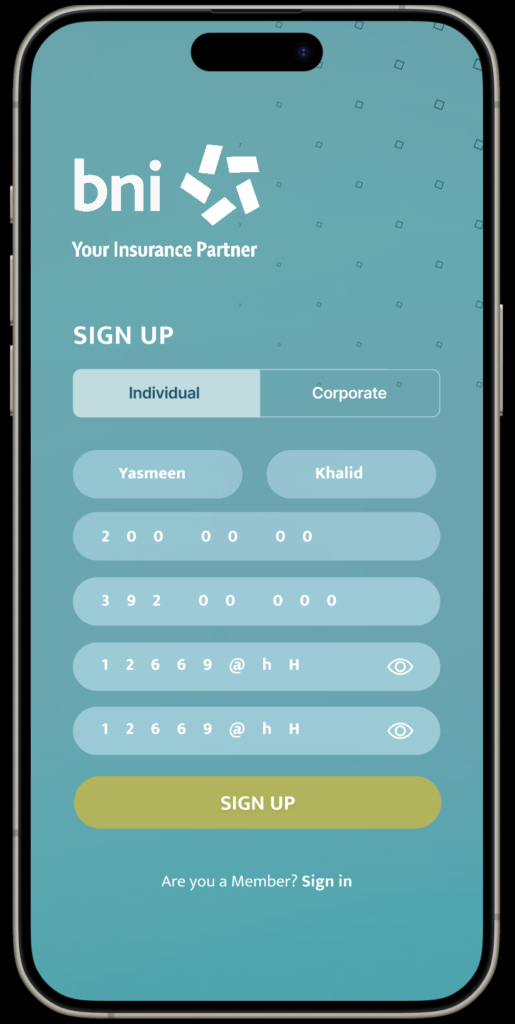

Addressing all findings from the research phase, and the identified challenges that Yasmeen & Adnan encountered in terms of seeking insurance services, our solution revolves around developing a mobile app focused on targeted Millennials & Gen Zs user needs, which is were follows:

We believe that by designing an up-to-date and user-centered insurance mobile application for Yasmeen and Adnan utilizing advanced searching & sorting methods, intuitive navigation, simple forms, clear policies, and effective & efficient claim way, we will provide them with a clear, affordable, reliable & flexible coverage offers where all coverage terms are mentioned & understandable, budget-friendly with offers, and customized and flexible renewal contract, they will be able to track requests and receive responses from home without waiting in lines. We will know this to be true when we see Millines & Gene Z engaged with the BNI Mobile App with increased registrations and insurance coverage contracts.

STORYBOARD

To visualise the predictive emotional transition of BNI personas before & after using the suggested mobile application, we storyboarded scenarios for both Yasmeen & Adnan as follows:

Yasmeen's

STORYBOARD

🙁

Yasmeen, a 23 years old Bahraini girl. She is trying to find a trusted motor insurance plan that suits her budget. She is so busy on her new job position, and do not have time to call or visit insurance companies.

🫤

She had a break time, so she browsed App store to search for Bahraini Insurance Company App. She found few list of Applications, but she liked the BNI specifications & featured so she downloaded the App and went to continue her work.

😇

On her way to home, she remembered the downloaded BNI App on her phone!

😃

She signed up as new user, head up to the search filter bar as mentioned on App store that the application have. She customised her plan based on her needs, then accomplished buying her customised insurance plan via virtual video call with a BNI agent.

😍

Yasmeen satisfies now about her experience with searching & customising insurance plan for her new car via BNI Application. She was so happy with how ease & fast was the process, and she is so amazed by the virtual on-call agent feature.

✦

Satisfied User

Adnan's

STORYBOARD

🙁

Adnan, a 34 years old Bahraini man. He hates waiting in lane to accomplish official papers or transactions.But now he needs to file a claim for his car accident. He feels so angry because of being on wait.

🫤

A BNI employee recognised Adnan's angry face, so he had a talk with him asking about his concern. The employee knew about Adnan's problem, so he recommended him to download BNI's new application to file a claim remotely.

🙂

Adnan already had BNI account on website, but he didn't know about BNI's App. He jumped to App store, read about filing & tracking a claim within the App.

🫨

He waits for the application to be downloaded.

😀

Adnan filed a claim & track his claim in few minutes only!

🤩

He feels satisfied about BNI new features, and he startts recommending the application for all his friends and relevant.

This research & defining method shaped and visualised the ups/downs emotions of both Yasmeen and Adnan, before, during and after using the proposed BNI App. So we could understand the impactful transformation from a mobile website version to a native mobile App for the new targeted generation. Additionally, we were able to highlight the contextual part of the process.

Extra Bonuses

- The storyboard highlights the importance of marketing the Application in advanced stages, so the targeted audiences be updated.

- As the downloaded phase shows down emotions we should take into consideration designing an Application with a simple layout and content, but at the same time covering the key needs of BNI’s targeted users.

Design Principles

Based on user interviews, C & C evaluation & the Must Have / Nice to Have features from previous Features priorities & MVP diagrams, our team agreed on the following design principles:

-

Native Mobile App

-

Customized modular insurance policies

-

24/7 Live chat and call center

-

Multi navigation methods

-

Wish-listed services & products

-

Transparent/clear/searchable policy documents

-

User-Friendly filing claims process

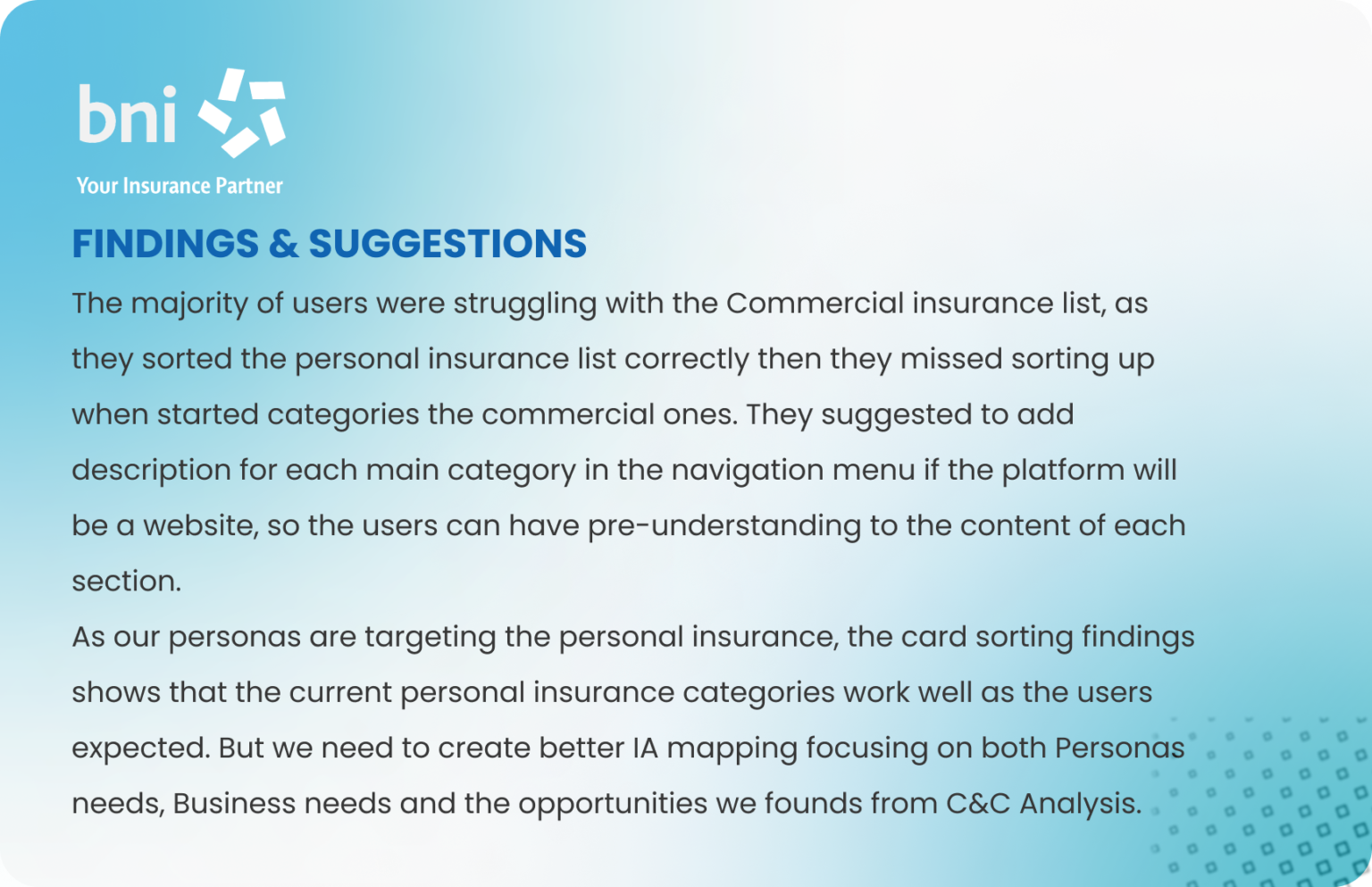

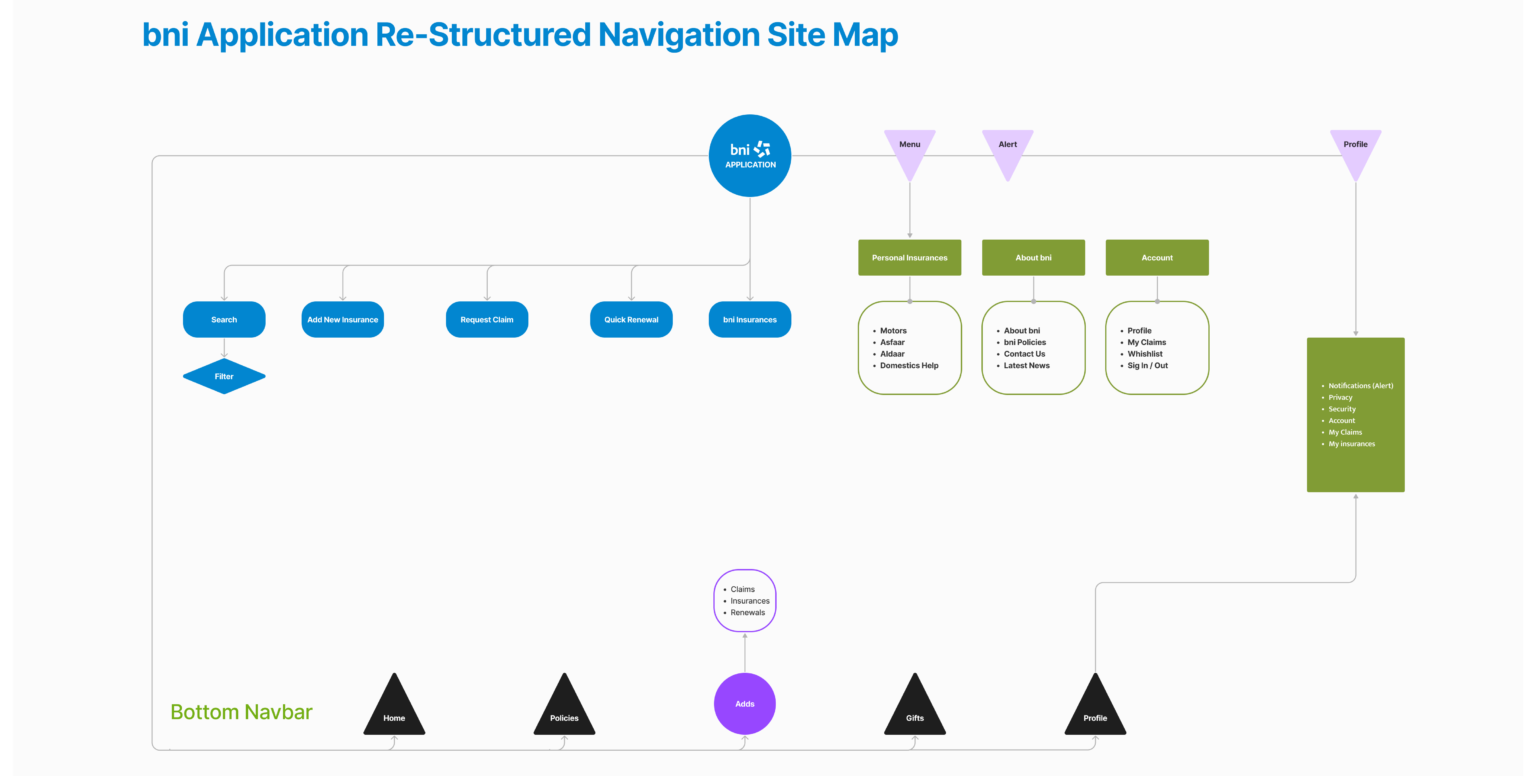

Re-Study BNI Site Map

We conducted an insightful session exploring the overall navigation of the BNI website, to understand products & services distribution. This activity allows us to highlight BNI's Personas paths for the proposed Mobile App by excluding all unnecessary/irrelevant categories or information. Which was the solid base for us to start the Card Sorting method.

<span data-metadata=""><span data-buffer="">

A Hybrid Card Sorting method has been conducted with 5 users.

Where this way combines between both, open & closed card sorting as BNI already have certain categories established, but It’s IA & structure still need to be tested to see if they work as expected with the target audiences & users, besides make the process flexible, so the participants can create their own groups & categories. The following are the Card Sorting Findings & Suggestions:

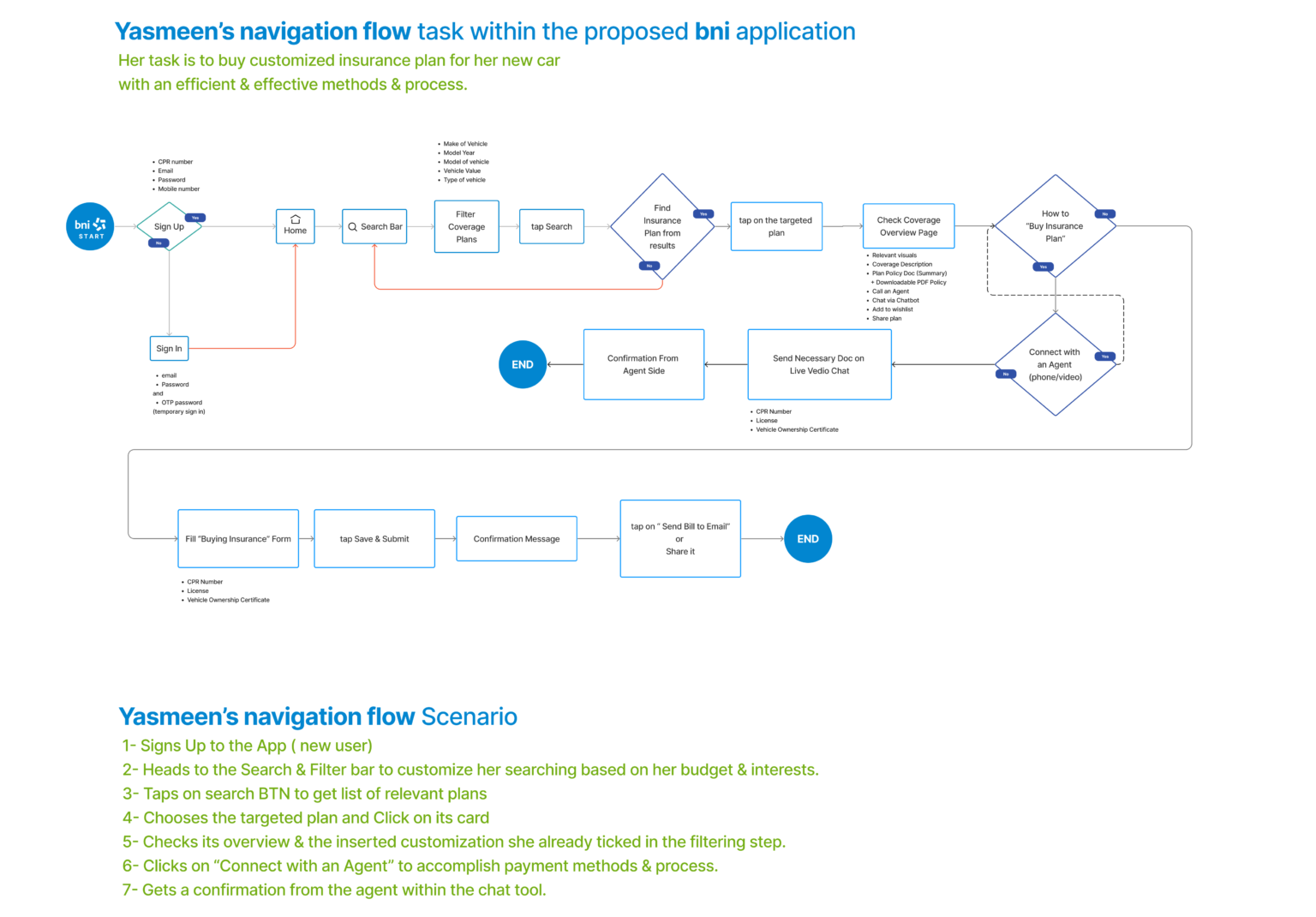

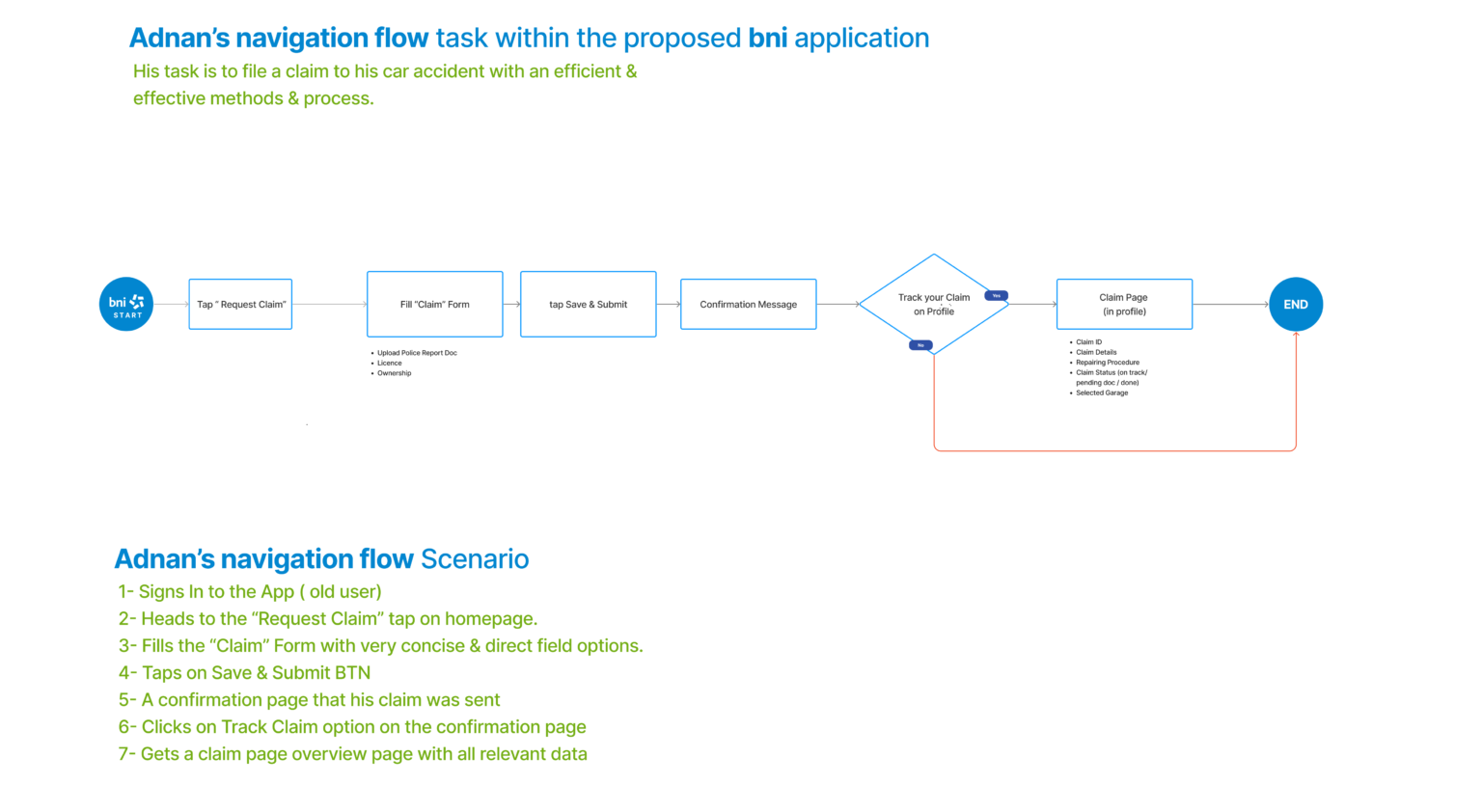

User Flows

We've crafted these user flows to map out the essential pathways and interactions that shape the optimal user experience for both Yasmeen (Gen Z) and Adnan (Millennials).

Branding Guideline

Following sketching and mapping the system design, we dedicated time to defining the foundational elements of the design system that would embody the organisation's visual identity. This groundwork preceded the initiation of the High-Fidelity design creation phase. This method gave us the ability to have a pre-assumption of how the design will look & feel, so if needs to change/improve or add to the overall design elements will be time & effort saving.

Design Phase

Learn about the audience we're focusing on.

Low-Fiedelty Sketches

We started designing by sketching and agreeing on content and overall appearance in a Design Studio session. We discussed and brainstormed UI design elements like colour scheme, branding, and typography, keeping them consistent with BNI's identity. For page layout and content mapping, we drew inspiration from a Pinterest mood board we created and incorporated some ideas from competitors, both direct and indirect, and this was the final Sketches:

Mid-Fidelity Wireframes

The resulting pre-sketches formed a solid & bold base to build up the first wireframe prototype for BNI users. The wireframes demonstrated the planned points of interest in terms of users' needs & scenarios, and their usability was ready to be tested.

Usability Test

We conducted usability testing to validate the efficiency and user-friendly nature of the prototype adding the fact that we wanted to measure the effectiveness of the updated areas that we worked on iterating them after conducting the usability test on the Sketches. Involving 6 participants, our primary focus was on completing the two user flows mentioned earlier.

All failures in the sketches’ usability test did not show in the mid-fidelity test which was an improvement.

As the usability test was conducted with 5 users, all users started with a search bar filter for Yasmeen’s task,

and for task two all users jumped to the buy insurance button as a way to find the agent’s guidance which

reflected a pass-planned navigation for her. Same with Adnan, where all users started with the Request claim option

on the BNI App’s home page, and all of them jumped to the profile icon on the bottom Navbar to track the claim.

But some new fails were recorded:

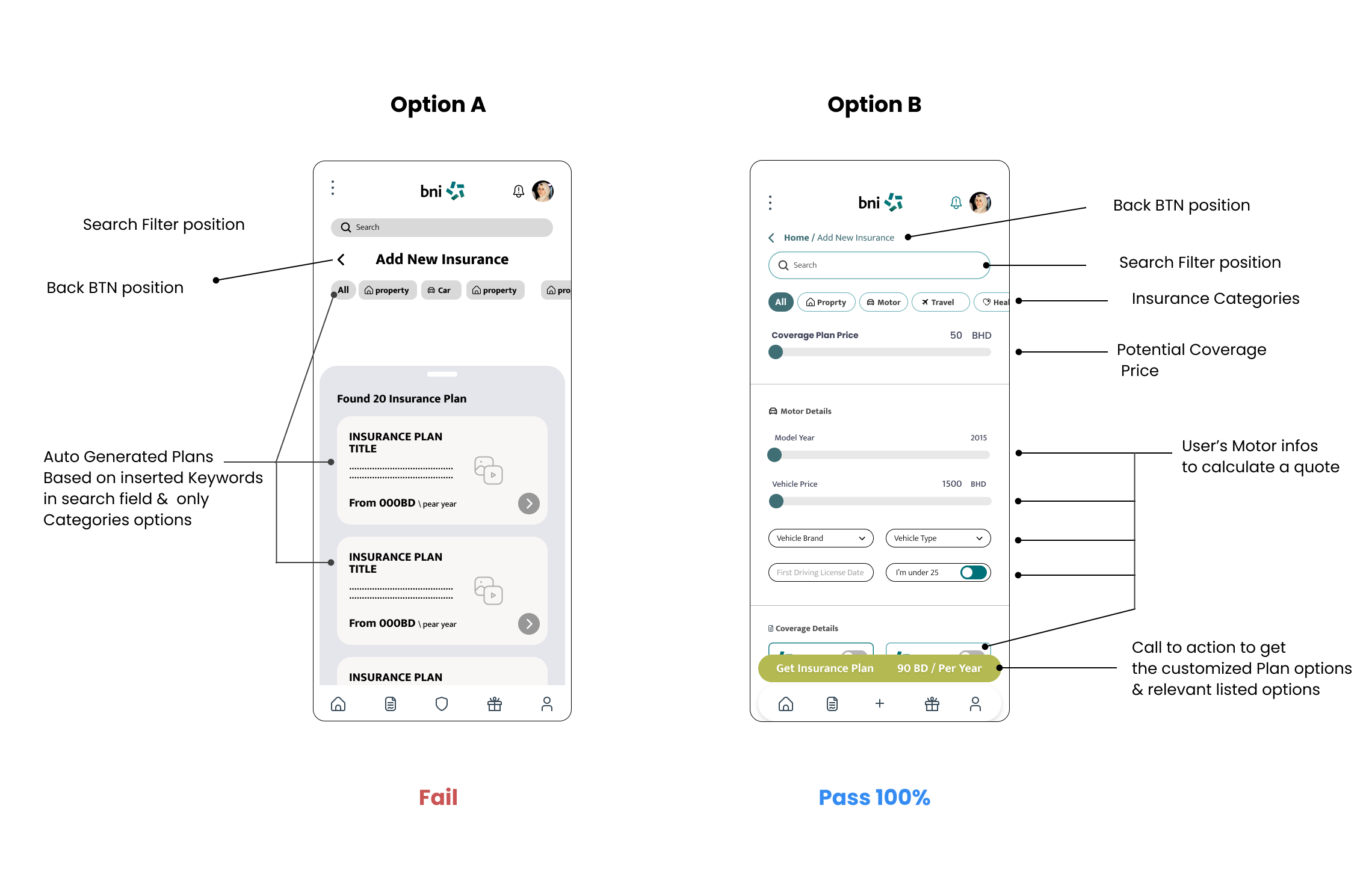

• 3/5 users Keep results on a separate page, not on the same Filter page, and as the user already filters

his/her options there should be one result based on the chosen options on the filter page. So the

results page should show the most mach insurance plans for the customized one as further options, besides

a detailed overview of the user’s filtered result with the final price after all customizations.

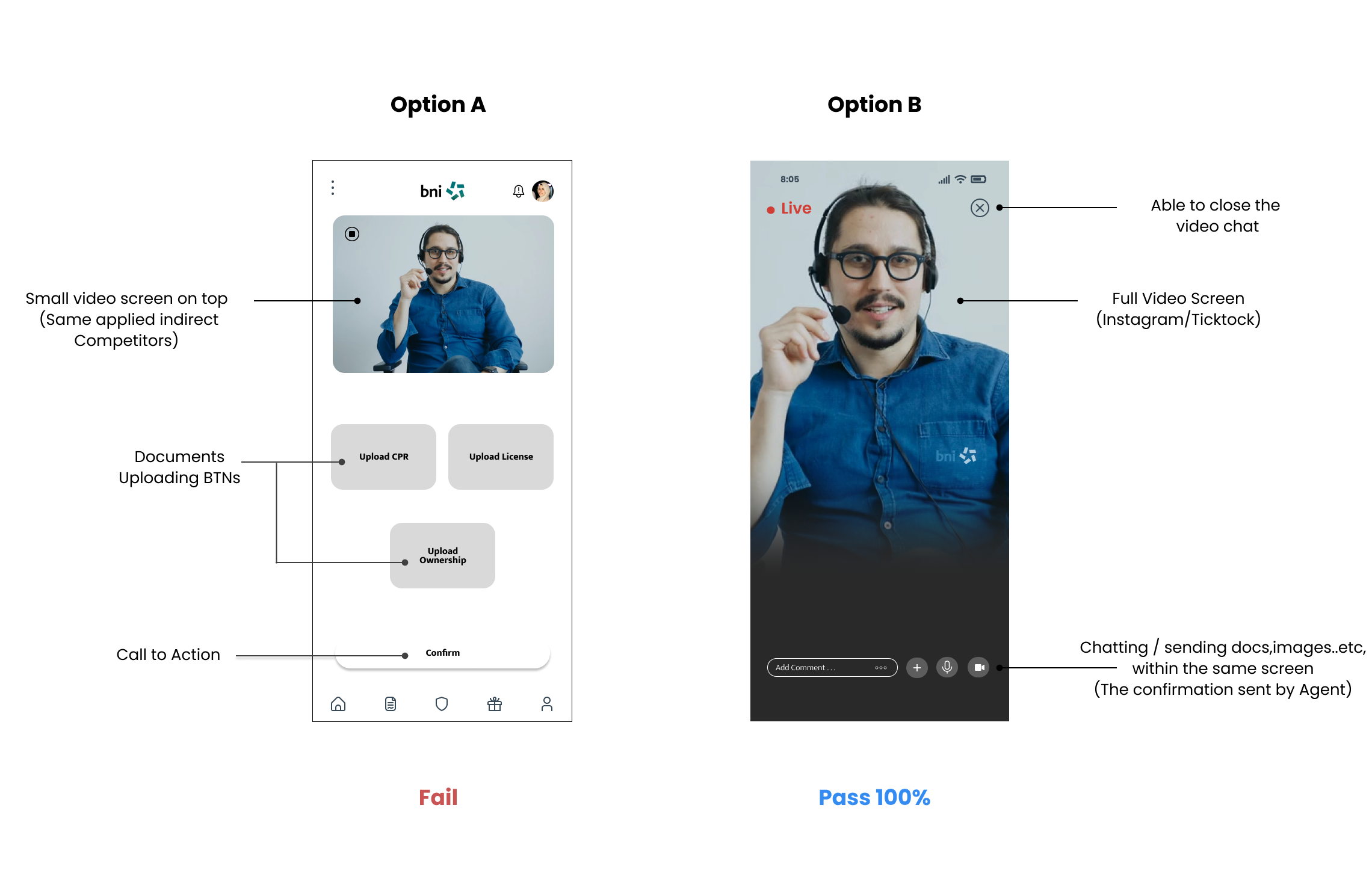

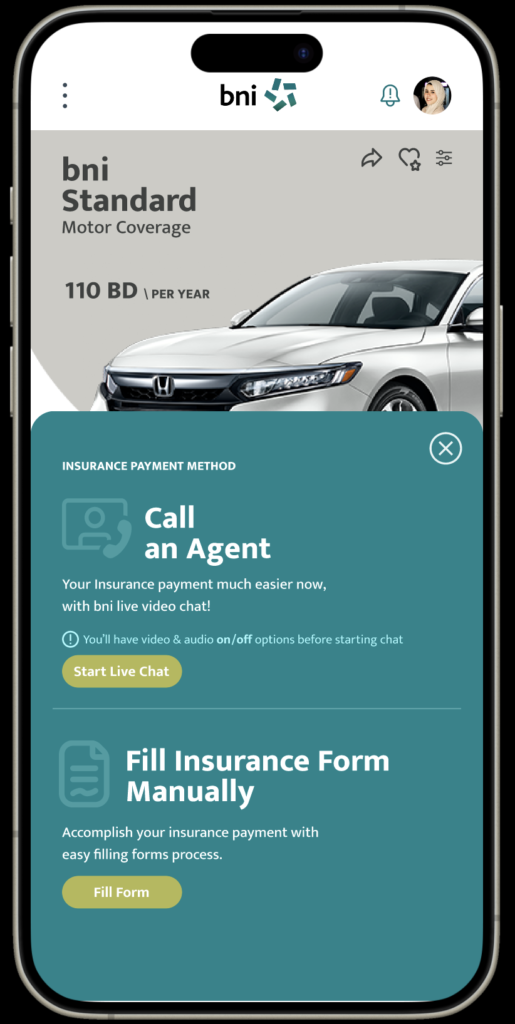

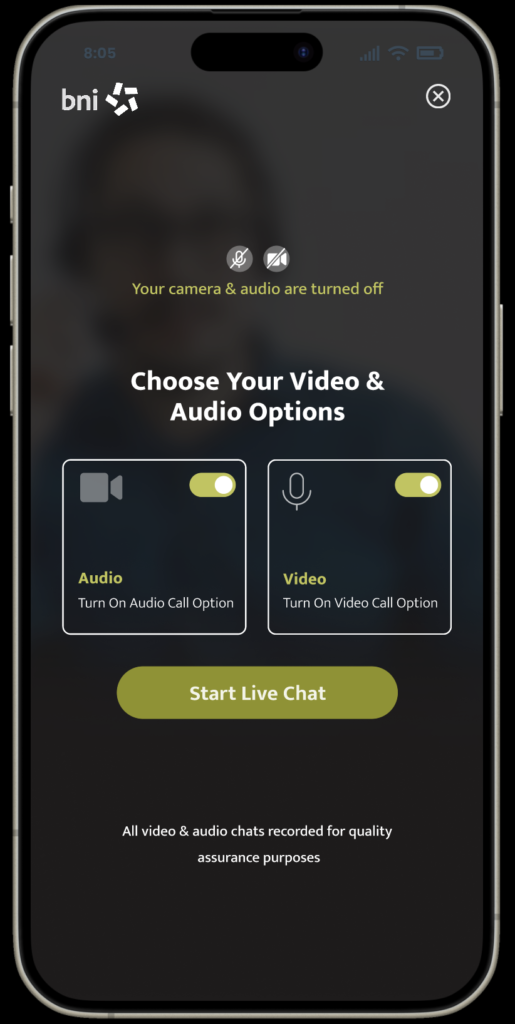

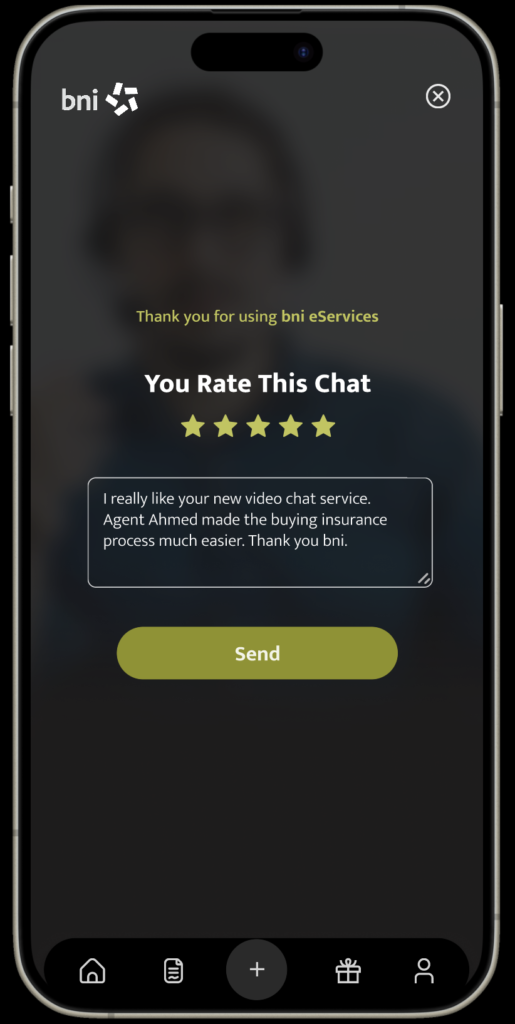

• 4/5 users did not understand the Live Chat structure, is it video or drag/drop files field

• 5/5 users got confused about My Insurances “Active tap” on the Home page in Yasmeens

the task she is a new user, so there shouldn’t be Active insurances, so there must be another

content appears for her on the homepage.

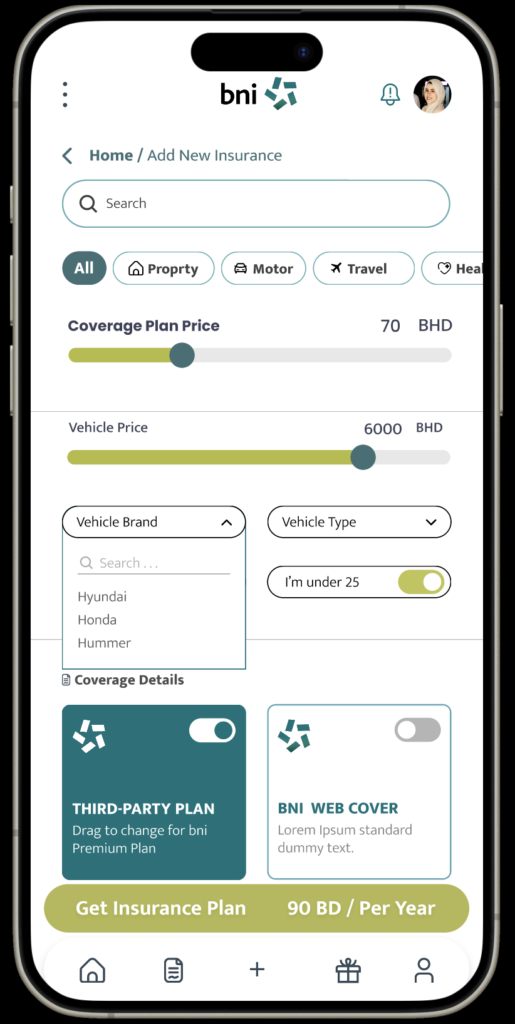

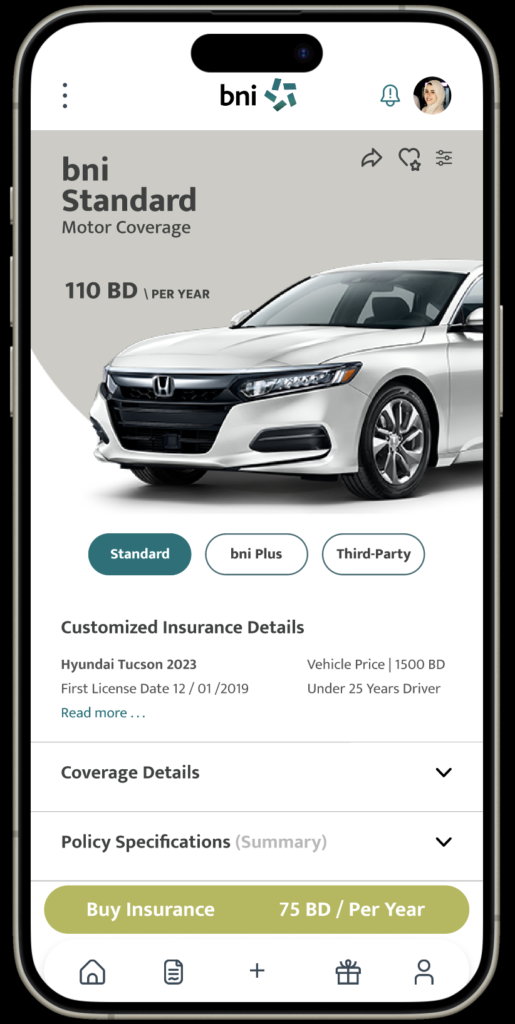

- The customized insurance plan result will appear on a separate page with relevant plans based on the user’s filtered options.

- Live chat will be full-screen live chat simulating Instagram Live-chat and the user can add comments, and docs /images, with optional cam/audio choices.

- The Active/Inactive/Popular taps will be structured based on users with insurance plans, or new users, so, for Yasmeen, the structure will be as: Popular (Active tap) / Active insurances (grey inactive tap) / Inactive insurances (grey inactive tap). But for Adnan, The Active insurance will be the (active tap).

Development & Feedback

After gathering feedback on the Mid-Fidelity wireframes from participants, we developed:

1- Two versions of the filter and results pages. Option A featured a single Filter page generating customized insurance plan results within the same page. Conversely, Option B comprised two separate pages: one for filtered insurance plan options with a call-to-action button leading to the next Results page.

2- Two versions of the Live Chat feature, Option A with split video and drop/Drag Files. Conversely, Option B shows full-screen video chat tracking the most popular live chat App for chatting and sharing files features.

So we conducted two A/B tests for both types of changes to find out which version of the functionality appealed more to users.

The outcomes of our A/B testing yielded significant insights, as 100% of participants favored the functionality provided by Version B in both sessions, describing it as straightforward, clear, and easy to use.

Based on this feedback, we agreed on the final tested B versions of the High-fidelity prototype as a Final prototype to be submitted.

Final Prototype

Yasmeen's Task Navigation

Final Prototype

Adnan's Task Navigation

Advancing Ahead

Navigating the Journey Forward in Growth and Development.

The UX & UI designing phase is a startup point that draws a roadmap towards the App development & launch phase, so from this point of start there are essential areas of focus that BNI’s Marketing & Development team should track and maintain:

- Since it is the first App version there should be an insightful plan for users’ account privacy & security, which reflects a main pain point & need for our persona. The OTP password would be a part of that plan.

- The AI searching Filter should be implemented to have a wide range of options that would be fed from a separate database of information that relies on users’ behaviours of searching & purchasing, which is another essential requirement for the personas.

- The virtual video service should have dedicated listed BNI agents, and all communications should be recorded and informed to be recorded, for extra safety & quality ensure. Which needs to be observed & discussed with a professional lawyer.

- A marketing campaign should be conducted in order to advertise the Application launch, taking in consideration the targeted. audiences

In the field of UX design, iteration stands as a fundamental principle and rule to ensure an enhanced user experience. The ensuing steps outline the next phase of development for the BNI App:

- Employ Conversions & returns analysis tools to measure the effectiveness of the latest updates & strategies.

- Design an application that works on both Android & IOS systems.

- Design the overall burger menu criteria to guarantee user satisfaction.

- Keep testing & implementing based on updated user feedback.

knowledge acquired

Summing up our experience.

My involvement in this UX design project equipped me with substantial knowledge and skills, contributing to the success of our project and reinforcing the ongoing commitment to ensuring a user-centred design approach.

I understand now after the practical work we encountered throughout this project that the research phase is a road map towards Business and user-centric design. Through conducting significant studies & research & evaluation of the BNI company, Targeted audiences and Competitors, we gained an insightful understanding of the insurance industry and highlighted weaknesses to avoid & strengths to track & develop.

The interview sessions made us get close to the users and Understand their needs & pain points. By sitting up with them and listening to their words face-to-face we were able to put ourselves in their shoes which shaped our design choices to suit real users’ needs.

Not to mention the significant approach to usability tests that we learned from testing our product is as important as building it. This method guided us to better, innovative & unique solutions that we did not think of throughout the past design process. The usability test guarantees that we provide a user-centric digital solution by ensuring that the final product is user-friendly, direct & easy.

Last but not least, this project opened a wide scope of belief in the fact that the successful design is not the most fancy one! but it exceeds that to a much more important aspect which is a Design in that the user is the hero of its story, every single element within it is tailored to solve a real need & to overcome a challenge he/she faces. A design that provides empathic digital solutions to its users.

This transformation between generations & technologies formed a challenging topic that needed to be solved for our client but with the power of UX design and its fundamentals that put user needs & business goals on one path toward success.

Our team understood that digital solutions should not focus only on the look of the overall design but should go abroad that scope to reach user needs, emotions, goals & challenges and put ourselves in the user’s shoes. This led us to tailor an Application that fit the BNI targeted audiences and craft the road towards loyalty & engagement.

Our dedication remains unwavering, and we are glad to be a part of this innovation that transforms insurance services for a new era and cultivates a future abundant with digital insurance services for the old & new generations.

Thank you for accompanying us on this remarkable odyssey.